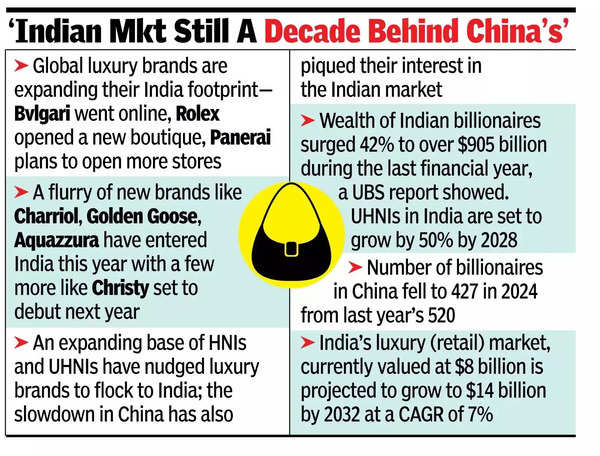

MUMBAI: Global luxury brands are flocking to India to tap into the growing number of high-net worth individuals (HNIs) in the country while a slowdown in neighbouring China is also nudging them to scout for new avenues of growth and take bolder bets on the market seen as a driver of luxury consumption in the decades to come.

“India is one of our fastest growing markets though our presence is currently concentrated in Delhi and Mumbai. Over the next decade, we anticipate India to become one of the most promising markets for the luxury industry, particularly for fine watches,” Jean-Marc Pontroue, CEO at Panerai told TOI.

Brands like Bvlgari, for instance, have come online in India of late in a bid to reach more consumers in a market where the restricted supply of luxury real estate make it difficult for brands to set up more stores in the region.

“In terms of the depth of luxury buying, India is still more than a decade behind China but reconstitution of consumption happening in China and the rising population of HNIs in India have definitely piqued brands’ interest to pursue India in a big way,” said Anurag Mathur, partner at Bain & Company.

While luxury brands present in the country are plotting their expansion strategies, several new global luxury brands like Swiss watch and jewellery brand Charriol, Italian footwear brands Aquazzura, Golden Goose have entered India with a few others like British home textiles player Christy set to debut in the market next year.

“I see a lot of people from the Indian community around the world buying in other countries that we already are currently in. I think being in the home country is very important to establish brand awareness. Indians are travelling more and for us, it is the right time to start in India,” Coralie Charriol, CEO and creative director at Charriol said in a recent interview. Charriol has partnered with Titan (through Helios) for its India foray and the plan is to widen the choice of luxury watches for Indian women.

The luxury (retail) market in India is pegged at $8 billion and is expected to expand to $14 billion by 2032, growing at a CAGR of 7%, analysts at BCG said.

For Rado, 2024 was another record year for the brand in India, said CEO Adrian Bosshard. “The key to our success are our high-tech ceramic products and qualitative distribution network,” said Bosshard.

Swiss luxury chocolate brand Laderach has witnessed a 15% year-on-year growth since its India launch in 2023. “Luxury brands are also tailoring their products to suit Indian preferences-whether it’s designing collections inspired by local culture, offering India exclusive products or introducing festive packaging. This localisation has strengthened their appeal in the country,” said Sanskriti Gupta, spokesperson at Laderach India.

DLF has seen strong interest from international brands keen to tap into India’s younger, digitally savvy audience, not just in metros but also in the next big cities, said Pushpa Bector, senior executive director and business head at DLF Retail. “Retail spaces like DLF Emporio and The Chanakya have set the stage for this influx, and we are actively engaging with several luxury players planning their India foray,” Bector said.

Besides, platforms like Ajio Luxe and Tata Cliq Luxury are helping brands reach smaller cities. “Rising affluence and aspiration in cities like Hyderabad, Ahmedabad and Chandigarh are expanding the market beyond traditional metros,” said Namit Puri, India leader, consumer goods practice at BCG.

While the overall local retail market is expected to double its growth by 2030, luxury retail is projected to grow six times, said Anand Ramanathan, partner, consumer products and retail sector leader at Deloitte India. “There will be more spending on luxury as a segment,” he said.