MUMBAI: The coming year is looking tough for India’s consumer goods companies.

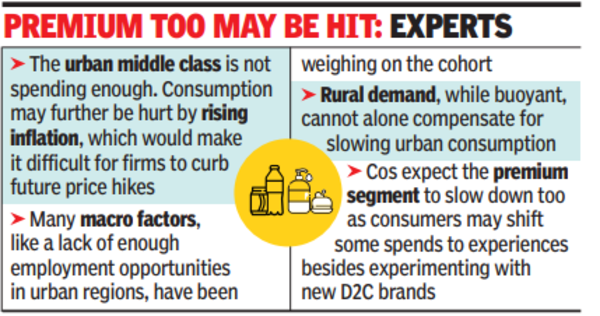

The urban middle class – key to driving sales volumes for mass brands – is not spending enough and rising commodity inflation means that firms may find it difficult to curb further price hikes, hurting consumption even more. While rural demand seems buoyant, it alone cannot compensate for slowing urban consumption unless some policy measures are introduced to incentivise the middle class to spend, analysts said.

Macroeconomic factors have been weighing on the middle class. A lack of enough employment opportunities in urban regions seems to have created some pressure on the segment, Soumya Mohanty, MD and chief client officer (insights division, South Asia) at Kantar, told TOI. “There has been a K-shaped recovery (post-Covid). The top (income segment) has expanded much faster. The middle is where the squeeze is happening. A lot of them are also tax-paying. Unless inflation eases or there are some policy/tax incentives in place, it will be difficult for mass consumption to improve,” he said.

It is the lower middle class that has borne the brunt of challenging macroeconomic conditions. Kantar describes this consumer cohort as those engaged in high grade blue collar jobs or low grade white collar jobs, with most households owning a motorcycle or other two wheelers.

Flowing with a rising market, the FMCG index too scaled a new high in Sept-end this year, despite signs of an incoming slow growth phase. Since then, as the numbers showed these companies were facing headwinds, the index too lost about 14%. Currently, at 20,812 points, the BSE’s FMCG index is almost at the same level as where it started the year.

“The current inflationary environment has created pressure on margins… we anticipate a temporary downward breach of the normative margins this quarter,” Godrej Consumer Products said, adding that the negative trends are likely to persist for a few months. Dabur said that continued inflation and macroeconomic headwinds might pose some challenges in the coming year. “…we will take action through a combination of price hikes, increased premiumisation and accelerated cost-saving initiatives to mitigate the impact of input cost pressures,” said CFO Ankush Jain.

Indicators such as reduced savings rates and increased debt levels – especially through credit cards and EMIs – reflect constrained disposable incomes, Mayank Shah, vice president at Parle Products, said. “This trend aligns with higher purchases of durables and automobiles on credit over the past two quarters, which contributed to robust sales in these categories. The higher reliance on credit and the resulting debt burden have impacted urban spending on FMCG products,” he said. The company doesn’t see revival of urban demand to set in at least before the June quarter of next year.

While companies have been focusing on premiumisation to drive growth, analysts said that there might be some slowdown in the premium segment as well going ahead. This is expected as consumers may shift some of their spends to experiences besides experimenting with new D2C brands in the market.