MUMBAI: Adani Green Energy is currently not looking for any fresh capital from its strategic partner French major TotalEnergies. TotalEnergies holds 19.75% in Adani Green Energy and a 50% stake in three renewable energy joint ventures with the company.

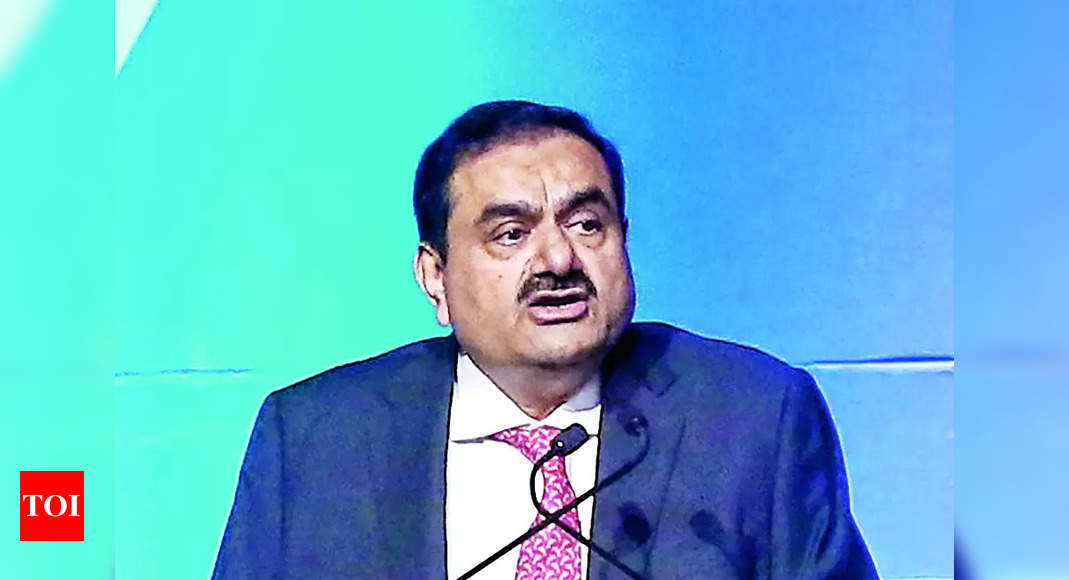

Adani Green Energy chairman Gautam Adani and executive director Sagar Adani have been indicted by the US for their alleged role in paying bribes to Indian govt officials to win lucrative business contracts for the company. On Tuesday, Adani Green said there is no new financial commitment under discussion with TotalEnergies. Its statement comes after TotalEnergies announced that it would pause additional investments in Adani Green due to corruption allegations against the company’s certain executives. Hence the press release (referring to TotalEnergies’ Monday statement) will not have any material impact on the company’s operations or its growth plan, said Adani Green.

Following the US indictment, Adani Green scrapped its planned $600-million foreign bond offering. While noting that Adani Green itself is not directly implicated in the US indictment, the French energy major vowed to safeguard its interests as a minority shareholder of the company and as a joint-venture partner in the renewable energy projects.

“Until the accusations against the Adani Group individuals and their consequences have been clarified, TotalEnergies will not make any new financial contributions as part of its investments in the Adani Group of companies,” the company said Monday. TotalEnergies also holds 37.4% in Adani Total Gas, which sells CNG to automobiles and natural gas to households.

TotalEnergies said it rejects corruption in any form. It added that it was not made aware of the existence of an investigation into corruption allegations and learned about the allegations through public announcements made by the US authorities.

The French major said it made the investments in Adani Group companies “in full compliance with applicable laws” and in line with its own internal governance processes pursuant to due diligence and representations made by the sellers. Previously, in Feb 2023, TotalEnergies had suspended its planned participation in Adani Group’s $50-billion green hydrogen initiative following Hindenburg’s allegations of accounting irregularities and stock market manipulation.