MUMBAI: Even as inflation has hit discretionary spending in the broader mass markets, the well-heeled continue to splurge.

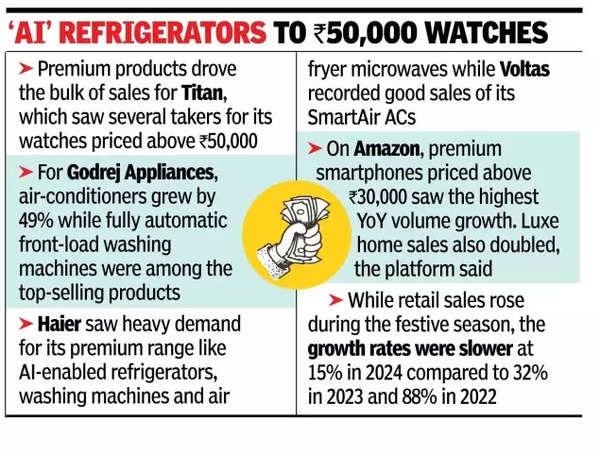

Titan’s watches priced above Rs 50,000 and its new Astra Meteorite pieces, which come with a price tag of Rs 1,30,000, saw takers this festive season. Premium products, in fact, drove the bulk of sales for the company, which claims to have recorded a 34% year-on-year growth in sales value in the recently concluded festive season. “Alongside, we also witnessed healthy volume growth of 27% (for watches), clearly indicating that consumer appetite for premium timepieces remains robust despite inflationary pressures,” Rahul Shukla, VP and chief sales & marketing officer (watches & wearables) at Titan, told TOI.

Inflation typically impacts the lower strata of society, those who allot their budgets towards essentials when there is an uptick in the general price level. Mirroring the trend seen over the past few years, premium has been the flavour this festive season too – across categories ranging from fashion to electronics. For Godrej Appliances, ACs grew by 49% while fully automatic front-load washing machines were among the top-selling products. “Discretionary spending continues to hold steady, especially for premium households,” said Kamal Nandi, business head & executive VP at the company which saw a 50% YoY growth in sales in October.

Haier saw heavy demand for its premium range like AI-enabled refrigerators, washing machines and air fryer microwaves while Voltas recorded good sales of its ‘smartair’ ACs. On Amazon, premium smartphones priced above Rs 30,000 saw the highest YoY volume growth. Besides, consumers added premium tablets from Apple and Samsung, as well as premium soundbars to their shopping carts. Luxe home – high-priced home decor and furnishing items – sales doubled, the platform said. A study by logistics intelligence platform ClickPost showed that online platforms clocked electronics orders with an average order value of Rs 38,000 driven by personal tech and smart home gadgets.

Although overall retail sales rose during the festive season, the growth rates were slower. Nomura estimates that sales grew at a slower 15% YoY in 2024 compared to 32% in 2023 and 88% in 2022. “The impact of inflation has been evident in mass markets where price sensitivity has curbed discretionary spending,” Badri Beriwal, chief strategy & business development officer at Bata India, said.

However, retailers are pinning hopes on the upcoming wedding season to fuel sales in the mass markets. Spending by the segment was not totally muted – categories like budget 5G smartphones priced at less than Rs 10,000, single-door refrigerators and semi-automatic washing machines have seen traction. “This growth in mass segment could also be linked to the onset of an extended wedding season across the country from mid-November,” Nandi said, adding that it is likely to result in higher sell-out at stores in the next two months as well.

“The festive period is still not over, there will likely be around 4.8 million weddings during the wedding season in November and December in addition to new-year related spending towards the end of the year,” analysts at Nomura said.