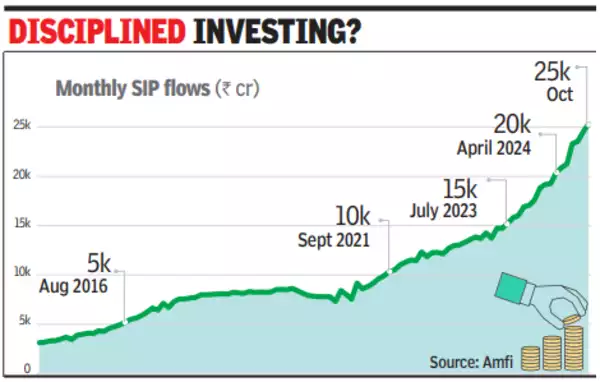

MUMBAI: Investors poured a record amount of money into mutual funds through systematic investment plans in Oct, largely ignoring a sliding stock market. Last month’s gross SIP inflow in fund houses stood at Rs 25,323 crore — the first break above the 25K mark ever — data released by Amfi showed. The total number of SIP folios also crossed the 10-crore mark during the month, the industry trade body said on Monday.

Equity funds recorded net inflows for a record-extending 44 consecutive months, starting March 2021. However, due to the stock market’s slide in Oct, the total assets managed by the fund category dipped by about Rs 1.2 lakh crore to Rs 29.9 lakh crore, from Rs 31.1 lakh crore in Sept.

Debt funds, on the other hand, witnessed a net inflow of nearly Rs 1.6 lakh crore. This category got a major boost from a Rs 83,863-crore net inflow in liquid funds. Strong inflows through the debt funds route also helped the total assets managed by the MF industry to soar to a record Rs 67.25 lakh crore, Amfi data showed.

The continued surge in SIP accounts, now exceeding 10 crore, along with a record monthly SIP contribution of Rs 25,323 crore, demonstrates the growing preference for disciplined investing among Indian investors, said Venkat Chalasani, chief executive, Amfi. “These milestones reinforce our commitment to making mutual funds the cornerstone of wealth creation for every Indian investor, as we continue to build a more financially inclusive nation.”

During Oct, among the equity category, sectoral & thematic funds saw the biggest net inflows at Rs 6,862 crore. With total assets worth nearly Rs 4.5 lakh crore, thematic funds are now the largest among the equity category funds, Anand Vardarajan, chief business officer at Tata MF, pointed out. In terms of net inflows, the thematic funds category was followed by a Rs 4,336-crore net inflow through small-cap funds and another Rs 4,263-crore through mid-cap funds.

“The healthy net flows are a testimonial to the resilience amongst domestic investors to continue investing in equities despite market volatility,” said Akhil Chaturvedi, executive director & chief business officer at Motilal Oswal MF.

With the passive category, gold ETFs saw a Rs 1,961-crore net inflow last month, up sharply from the Rs 1,233 crore in Sept. “Global uncertainty, geopolitical tension, global inflationary pressure and uncertainties around interest rate have reinforced gold’s status as a safe haven,” said Himanshu Srivastava of Morningstar Investment Research India.