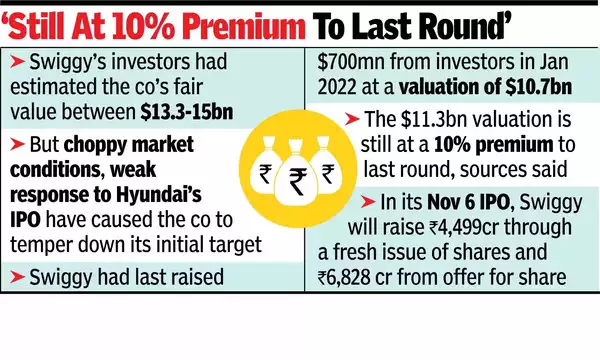

MUMBAI: Swiggy is targeting a valuation of $11.3 billion for its Rs 11,327 crore (close to $1.4 billion) initial public offering (IPO), which is set for a Nov 6 launch.

The food delivery startup has tempered down its initial target of up to $13 billion valuation amid choppy market conditions and weak response to Hyundai India’s market debut, sources told TOI.

“Had the market conditions been better, Swiggy may have looked at a valuation of $12.5-13 billion. Besides, it’s the only over $1 billion IPO slated to be launched globally during the time of the US elections,” sources said.

Swiggy will raise Rs 4,499 crore through a fresh issuance of shares, while the offer for sale component will amount to Rs 6,828 crore, sources said. Swiggy’s largest shareholder Prosus, along with other investors including Accel and Elevation Capital, are selling a portion of their stakes in the IPO. SoftBank is not selling any shares.

“As a consumer company, we want to place more on the table for retail investors. The $11.3 billion valuation is still at a 10% premium to the last equity round,” sources said. Swiggy had last raised $700 million from investors in Jan 2022 at a valuation of $10.7 billion.

Swiggy’s investors had, in fact, estimated the fair value of the company between $13.3-$15 billion, sources said. In Oct, however, the sensex has plunged 6,434 points from its Sept 26 life-high of 85,836. Selling by foreign funds is the main reason for the market’s slide.

Swiggy’s IPO is the biggest to be floated by an Indian startup after Paytm’s Rs 18,300 crore IPO in 2021. Rival Zomato had raised Rs 9,375 crore through an IPO in 2021. Swiggy competes with Zomato in both the food delivery and quick commerce segments.