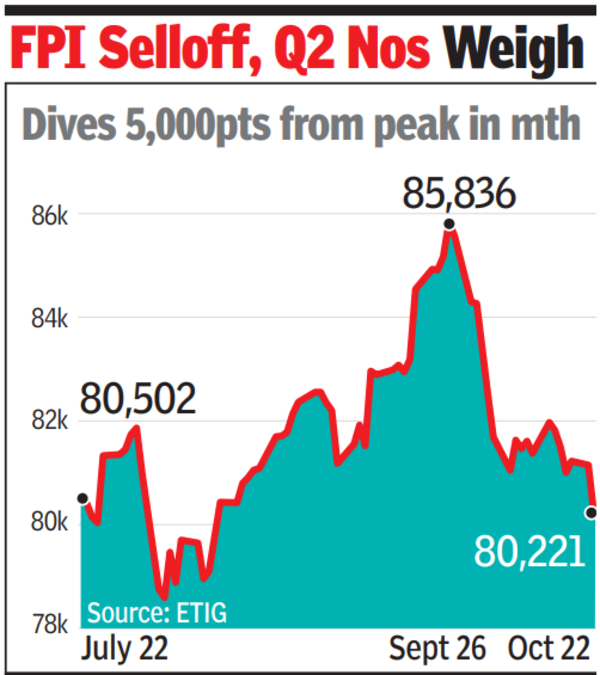

MUMBAI: The sensex plunged 931 points, its biggest single-day drop in three weeks, on Tuesday, driven by disappointing corporate earnings and sustained selling by foreign portfolio investors who continued to sell India and buy China. The sensex fell below its July 22 level of 80,502 to 80,221 on Tuesday, paring all gains of the three months.

Nifty fell 1.3% to 24,472, and the sensex dropped 1.2% to 80,221.Both indices gained about 0.4% in early trades before reversing course, marking the worst session since Oct 3. Investors’ wealth declined by about Rs 9.2 lakh crore as the sensex lost 1,002 points intraday. Hyundai Motor India also made a muted debut on Tuesday, listing at a 1.3% discount to its issue price of Rs 1,960. The stock ended its first day of trading 7.1% lower.

Foreign investors net sold Rs 3,978.6 crore worth of stocks from the Indian markets on Tuesday. Their selling was absorbed by purchases from domestic mutual funds and insurance companies, which bought shares worth Rs 5,869 crore. Overall sentiment, however, remained weak.

“There has been no respite from FPIs selling in local equities in the current month so far, which has been creating uncertainty among domestic investors. Also, foreign investors are fleeing Indian equities to invest in relatively cheaper locations such as China, especially after the stimulus announcement by its govt to boost its slowing economy,” Prashant Tapse, senior VP at Mehta equities, said. The broad market underperformed too, with all 13 major sectoral indexes declining and 47 of the Nifty 50 stocks posting losses. Small-cap stocks fell 4%, while mid-caps declined 2.6% – their worst performance since Aug 5.

Hyundai Motor India’s IPO – which raised Rs 27,870 crore – was the largest in Indian history, surpassing LIC’s Rs 21,000 crore IPO. Despite the discounted listing, the majority of analysts were positive on the company’s fundamentals and growth prospects.