MUMBAI: In a move that could result in a multi-billion dollar cashing out by a foreign partner, Allianz has indicated to Bajaj Finserv that it wants to exit from their joint ventures in life and non-life insurance and pursue other opportunities in the Indian market. The two companies are partners in Bajaj Allianz General and Life Insurance companies.

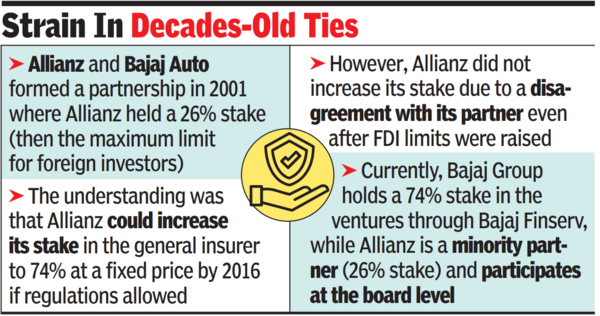

Currently, the German insurer holds a 26% stake in both ventures. Despite relaxed FDI limits, Allianz did not increase its stake due to a disagreement with its partner after a two-decade-old agreement to raise the stake at a pre-agreed price could not be implemented within 15 years as was envisaged earlier.

As of March 24, Bajaj Allianz General holds a 7% market share in the non-life business, making it the second-largest private insurer after ICICI Lombard, which has a 8.5% share and a market capitalisation of Rs 98,000 crore. Similarly, Bajaj Allianz Life has a 7.4% market share among private life companies. The joint venture dates back to 2001 and has survived decades.

Allianz has said that it remains committed to the Indian insurance market, and there is speculation on whether it will tie up with another partner or go alone. While most business houses have already floated an insurance company, Jio Financial Services is understood to be preparing to launch its insurance business.

The split marks the coming of age of Indian joint ventures whose valuations are now a significant part of their multinational parent. For instance, the largest private life company HDFC Life has a market cap of nearly Rs 1.6 lakh crore as against Rs 33,590 crore of its one-time parent Abrdn (formerly Standard Life). Similarly, Prudential has a market cap of Rs 1.9 lakh crore as against the Rs 1.1 lakh crore valuation of ICICI Prudential.

An exit by the German insurer would entail either a buyout by Bajaj or a stake sale to new investors or divestment through an IPO. Analysts do not see an impact in the insurance operations of the two companies as the foreign partner’s participation is only at the board level and domestic operations are not dependent on Allianz for technical support.

“Allianz, in case it exits the joint venture, has committed full support to Bajaj in ensuring a smooth transition to the Bajaj brand, keeping in mind the interest of policyholders, business partners, employees and other stakeholders of the insurance companies,” Bajaj Finserv said in a statement to the exchanges.

In 2001, German insurer Allianz and two-wheeler manufacturer Bajaj Auto formed a partnership, with Allianz holding a 26% stake – then the maximum allowable limit for foreign investors.