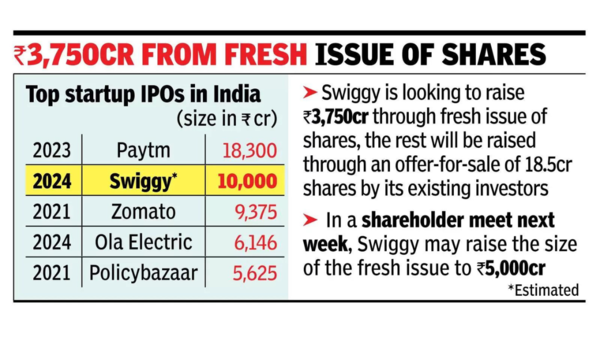

MUMBAI: Food & grocery delivery company Swiggy on Thursday filed papers for an IPO that is expected to be worth about $1.2 billion (or Rs 10,000 crore) – the biggest floated by an Indian startup since Paytm’s Rs 18,300 offer in 2021. The IPO is expected to be up-sized to about $1.4 billion (or Rs 11,700 crore) in a shareholder meet next week, sources said.

Swiggy is looking to raise Rs 3,750 crore through issuance of fresh shares, while the remaining amount will be raised through an offer-for-sale of up to 18.5 crore shares by existing investors, the Bangalore-based company’s updated draft red herring prospectus (DRHP) showed.

Earlier this week, markets regulator Sebi had green-lighted Swiggy’s IPO filed through the confidential filing route in April this year. While the timing of the issue is not yet known, Swiggy may look at a Nov listing which coincides with Diwali festivities often considered to be auspicious for new investments, sources said.

In an extraordinary general meeting with shareholders next week, Swiggy is likely to raise the size of the fresh issue to Rs 5,000 crore, sources said.

Swiggy’s IPO is larger than rival Zomato’s, which debuted on Dalal Street in 2021 with its Rs 9,375-crore offer. The startup’s largest shareholders Prosus, Accel, Elevation Capital and Norwest Venture Partners are among those selling. Swiggy will use a portion of the IPO proceeds to scale up its quick commerce business by expanding its network of dark stores.

A batch of startups including Ola Electric and FirstCry got listed on the bourses this year amid a robust IPO market, which saw $7 billion worth of IPOs hit the street in the first half of FY25. New-age tech companies, in fact, are on course to log their best IPO fund-raising year since 2021 during which the first wave of big startup IPOs had swept Dalal Street. Swiggy was last valued at $10.7 billion when it raised $700 million from investors in Jan 2022. The company’s revenue from operations stood at Rs 3,222 crore in Q1 FY25 while it posted consolidated losses of Rs 611 crore. Rival Zomato is profitable.