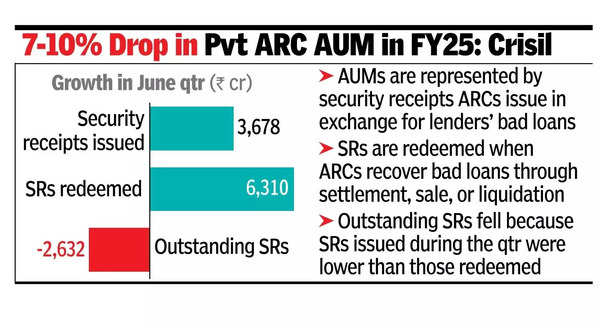

In the June quarter, AUM declined by Rs 2,632 crore for the first time. These assets are represented by security receipts (SRs) issued by asset reconstruction companies (ARCs) in exchange for bad loans from lenders, reflecting the market value of these loans.Outstanding SRs fell from Rs 1.4 lakh crore in March 2024 to Rs 1.37 lakh crore in June. The decline occurred because SRs issued during the quarter (Rs 3,678 crore) were lower than those redeemed (Rs 6,310 crore). SRs are redeemed when ARCs recover bad loans through settlement, sale, or liquidation.

While the fresh addition of bad loans has been low, the improvement in economic conditions has slightly sped up recovery, which is reflected in the redemption of SRs. Crisil projects a 7-10% shrinkage in private ARC AUM this fiscal year as acquisitions slow and redemptions remain strong.

“The possible widening of the seller base to include mutual funds and alternate investment funds, as recommended by RBI’s Sudarshan Sen Committee, may create new opportunities,” said Harihara Mishra, CEO, Association of ARCs.

Mishra also urged for the rationalisation of governance and compliance requirements. “The sanction of small loan settlements at the board level is impractical and needs revision. The Rs 1,000 crore net worth requirement for ARCs as Resolution Applicants, even for small loan resolutions, is disproportionate,” he added.

According to Crisil, with non-performing assets at a decadal low and better recovery performance, the trend of negative AUM growth is expected to persist. Crisil forecasts private ARC AUM to fall from Rs 1.35 lakh crore to Rs 1.2-1.25 lakh crore by FY25.