In the new week, the Bank of Japan, too, will decide on whether to change its interest rates, which will also impact markets globally.The US Fed and BoJ are poised to move in opposite directions on rates.

In addition, the listing of Bajaj Housing Finance — which set several records for the IPO segment of India — will also decide how investors look at other offers in the pipeline.

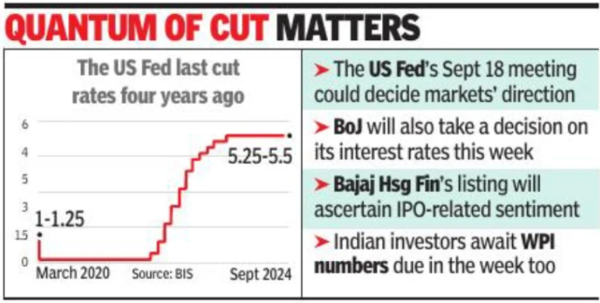

The impact of the US Fed’s rate decision on Sept 18 will be felt in the Indian market on Thursday. “With a 25 basis points (100 basis points =1 percentage point) rate cut already priced in, a significant market reaction is unlikely. The Fed’s guidance on inflation, growth, and future rate cuts will be key in shaping broader market sentiment, particularly regarding global liquidity and risk appetite,” said Ajit Mishra, SVP (research), Religare Broking. “A 50 bps cut could spark a positive reaction, especially in emerging mar kets like India. However, this effect may be short-lived as it could also raise concerns about the underlying strength of the US economy.”

The decision on rates by BoJ is set for Friday, when Indian markets will be open. Any decision to hike rates could trigger another round of unwinding of speculative contracts based on Japanese yen (called yen carry trade) and have the potential to trigger high volatility in global markets, like the one witnessed in early Aug, market players said.

Indian investors are also awaiting the WPI numbers due in the week. The domestic market would be impacted by how foreign funds position themselves after the decisions by the US Fed and the BOJ.

The listing of Bajaj Housing Finance, set for Monday, would decide the Street’s direction relating to IPOs. On Sunday night, the grey market premium for the stock — that gives some indications about the listing of a stock — was hovering around Rs 76 per share, while the IPO price was set at Rs 70. Going by this, investors are expected to double their money on listing.

The week would also witness the listing of PN Gadgil Jewellers, which had a strong IPO as well. Investors will have the option of investing in at least seven IPOs in the week, data on BSE and NSE showed.