A report by Knight Frank last month said that home sales of over Rs 1 crore now account for 41% of India’s housing sales.Home loan numbers point to this not being a blip but a continuing trend.

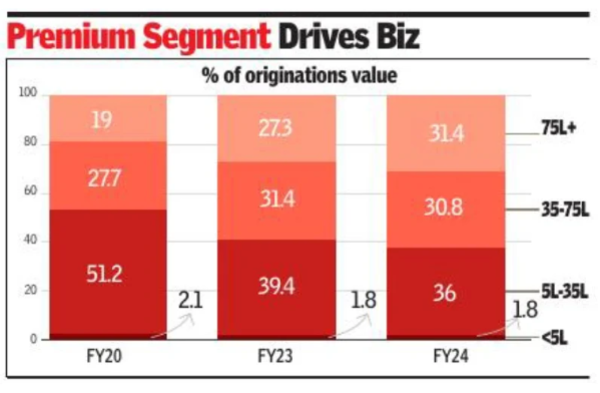

The increase in the shares of homes valued at over Rs 75 lakh has been consistent – going to 20.6% in FY21, 24% in FY22 and 27.3% in FY23.

Premium segment drives biz

While public sector banks are dominant players in the below Rs 75 lakh segment, private banks lead in the Rs 75 lakh category loans. In the below Rs 35 lakh loans, housing finance companies hold concentration, according to a report by credit bureau CRIF. Unlike RBI’s data on sectoral deployment of bank credit, CRIF’s data includes credit across lenders including finance companies and HFCs.

As of March 2024, portfolios outstanding of home loans – which are dominated by public and private banks – stood at Rs 36.2 lakh crore (across lenders).