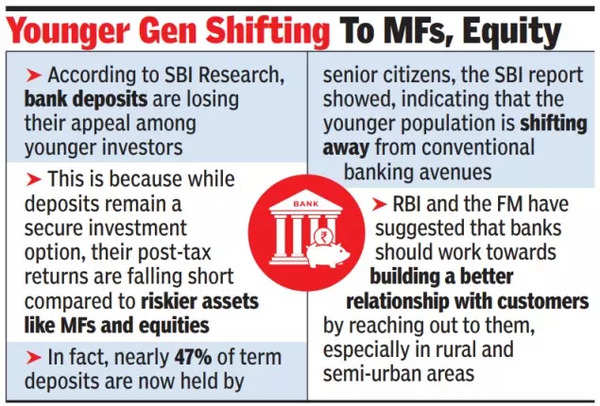

The minister’s comments at a meeting with public sector bank chiefs came amid data by SBI Research suggesting that bank deposits, traditionally favoured for their safety and liquidity, are losing their appeal among younger investors.While deposits remain a secure investment option, their post-tax returns are falling short compared to riskier assets like mutual funds and equities.

While seeking a review of the tax structure for bank deposits, SBI economists argued that nearly 47% of term deposits are now held by senior citizens, the report showed, indicating that the younger population is shifting away from conventional banking avenues. In contrast, the median age of investors in capital markets has dropped to 32 years, with approximately 40% of these investors being under 30.

Most banks offer up to half a percentage point higher return to senior citizens. At the same time, most senior depositors can claim exemption from tax deduction at source. With lending growth remaining higher than deposits, RBI and the FM have underlined the need to immediately address the issue so that it does not result in a “systemic risk” in the future.

At Monday’s meeting, Sitharaman suggested that banks should work towards building a better relationship with customers by reaching out to them, especially in rural and semi-urban areas. The minister also pushed banks to strengthen their tech platforms to guard them against any cyber threat so that their systems are not compromised.

“FM advised that issues of cyber security should be seen from a systemic perspective and emphasised that a collaborative approach between banks, govt, regulators and security agencies is needed to put in place necessary mitigants against cyber-risks. FM also urged that every aspect of the IT system should be reviewed periodically and thoroughly from the cyber security angle to ensure that the security of the bank systems is not breached or compromised,” an official statement said.

Sources said deposit mobilisation was a key theme. With stock markets performing better and mutual funds becoming a major investment tool, investors – especially in the younger age group – have opted out of fixed deposits. The tax treatment also makes them unfavourable.

The SBI report recommended delinking the tax treatment from the highest income bracket and instead taxing deposits at the time of redemption rather than on an accrual basis. SBI’s analysis also explores the impact of taxes on deposits, using data from 1970-71 to 2023-24. The findings reveal that if per capita income increases by Rs 1,000, bank deposits increase by Rs 613 when considering taxes as a factor. Without the tax impact, deposits could have risen by Rs 652, suggesting a 7% reduction due to taxation.

According to the report, mutual fund investor accounts have grown nearly fivefold from a little under 4 crore in March 2014 to over 19 crore in June 2024. However, the number of unique investors has only increased marginally, suggesting that many investors are diversifying their portfolios across multiple mutual funds.