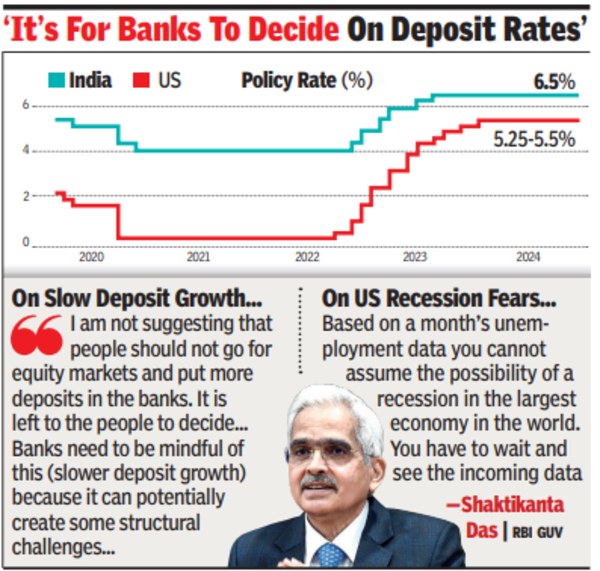

The six-member monetary policy committee voted 4:2 to keep the repo rate — the rate at which the central banks lends to banks — at 6.5% and to continue focusing on withdrawing accommodation to align inflation with the target while supporting growth.“Growth remains resilient, inflation has been trending downward and we have made progress in achieving price stability; but we have more distance to cover.

The progress towards our goal of price stability has been uneven due to large and persistent supply side shocks, especially in food items. We need to remain vigilant to ensure that inflation moves sustainably towards the target, while supporting growth. This approach would be net positive for sustained high growth,” Das said in a statement after the meeting of the monetary policy committee.

Although the policy maintained a status quo in terms of action, many read the governor’s statement as hawkish. Particularly his comments cautioning banks on growing credit faster than deposits. Das asked banks to beef up household deposit mobilisation by leveraging their branch network and through innovative service offerings.

Das retained the growth forecast for FY25 at 7.2% but cut down the forecast for Q1FY25 to 7.1% from 7.3% earlier due to updated information on high-frequency indicators, which show lower than anticipated corporate profitability, general government expenditure and core industries output. The governor also retained the inflation forecast for FY25 at 4.5% even as he tweaked quarterly forecasts.

According to RBI, the slowdown in deposits is partly because of a winding down of precautionary savings that households have built up during Covid when avenues were limited.