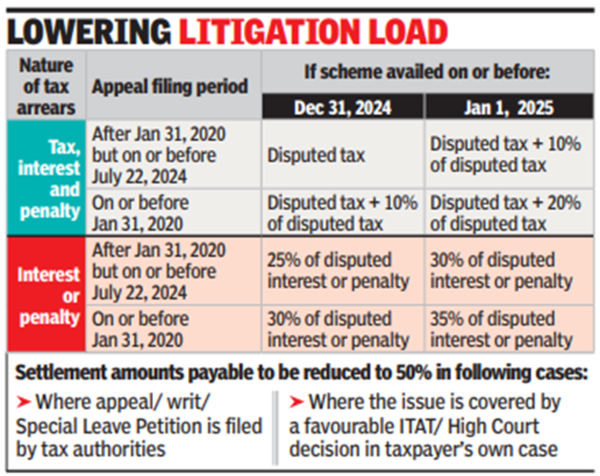

Gautam Nayak, tax partner at CNK & Associates, said, “VVS-2024 is on lines similar to the 2020 scheme where the taxpayer had to pay the disputed tax where he was in appeal, and 50% of the disputed tax where the tax department was in appeal, to settle the matter. The amount payable would be 10% higher if the appeal was filed before Jan 31, 2020, or if the settlement amount is paid after Dec 31, 2024 (see table). This scheme is likely to commence in the last quarter of 2024, from such date as may be notified.”

“Unfortunately, this scheme would benefit only those taxpayers who feel that their appeal is on weak grounds, and may prefer to settle it without payment of any penalty or interest. Taxpayers who have a strong case and whose appeals are long pending before Commissioner (Appeals) may not derive much benefit under this scheme,” added Nayak.

Sandeep Bhalla, partner, Dhruva Advisors, said, “The idea is for the I-T department to realise the outstanding tax demands quickly and free both the taxpayer and the department from protracted litigation. It is a matter of record that the maximum pendency of appeals is at the CIT (Appeal) – Faceless level. In my view while it is a welcome move the government may not be as successful as in previous scheme as most appeals today are pending at CIT (Appeals) level and several faceless assessments are high pitched where the taxpayers have a considerable chance of success.”

Gopal Mundhra, partner, Economic Laws Practice (ELP), said, “The 2020 scheme explicitly covered the cases where an order has been passed by an appellate authority or court and the time for filing any appeal has not expired as on the date of making declaration. The VVS – 2024 scheme is silent on this.” He adds that the 2020 Scheme also required a declarant who has initiated arbitration proceedings under any agreement entered into by India with any other country or territory outside India whether for protection of investment or otherwise, to withdraw the claims made in the arbitration proceedings, this is not specified in the VVS-2024 scheme.

Certain categories of cases will not be eligible for settlement under VVS-2024.