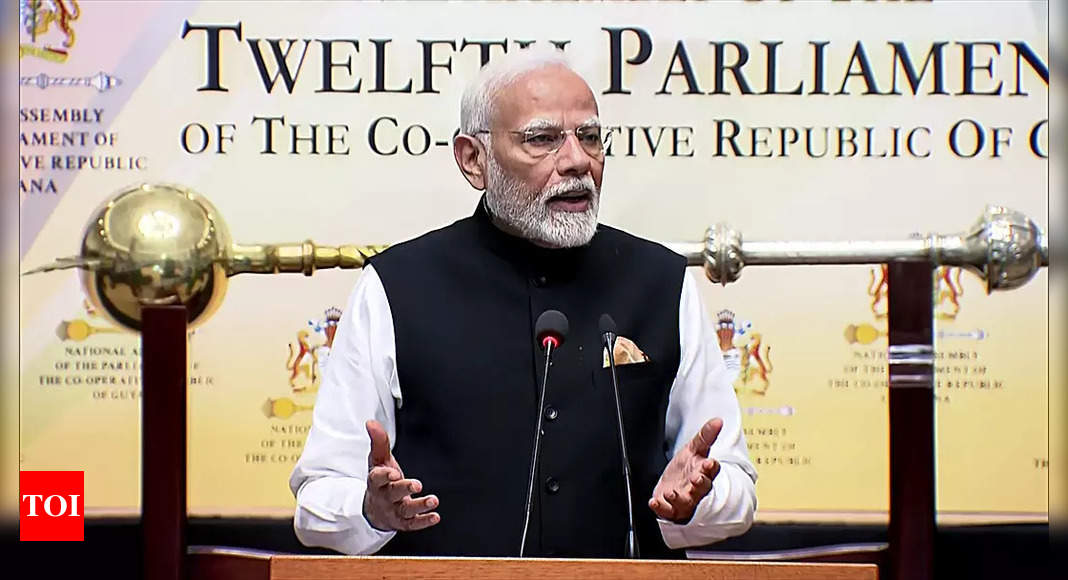

Income Tax Expectations Budget 2024: The Modi government has been looking to make the new income tax regime more attractive for the common man, middle class and salaried income taxpayers. Raising of basic exemption limit, introduction of standard deduction, and tweaking of tax slabs and rates under the new tax regime signal that the government wants taxpayers to shift to the new regime.

Finance Minister Nirmala Sitharaman will present the Union Budget 2024 on July 23, 2024 and personal tax experts are of the opinion that some changes in the new income tax regime can be expected.

What can be done to make the new income tax regime more attractive than the old tax regime, especially for individuals who have done their tax planning based on the old regime? TOI Online Survey of personal tax experts finds out:

Also Check | Budget 2024 Live Updates

New Income Tax Regime: What should change?

All personal tax experts unanimously agree that to make the new income tax more attractive for taxpayers, especially for middle class salaried taxpayers, the government needs to tweak it to introduce more deductions and exemptions.

1. New Tax Regime: Deduction for housing loan

One common deduction that experts believe should make way into the new income tax regime, and one that makes the old tax regime more lucrative for taxpayers, is housing loan deduction.

Preeti Sharma, Partner, Tax & Regulatory Services, BDO India LLP says that currently under the new tax regime, exemption against interest paid on home loan taken for a self-occupied or vacant property is not available. “This provision may be relooked at and be allowed under the new tax regime,” she tells TOI.

Agrees Kuldip Kumar, Partner at Mainstay Tax Advisors, saying, “the deduction for interest on housing loan may be introduced to make it (new tax regime) better for those who still chose the old tax regime.”

Also Read | Income Tax Expectations Budget 2024: What are the ideal new tax regime slabs, rates for middle class, salaried? TOI Online Survey findings

2. New Tax Regime: Hike basic exemption limit, standard deduction

Yet another recommendation is to increase the basic exemption limit and standard deduction under the new regime.

“Increase in the basic exemption limit from Rs 3 to 5 lakhs, raise the standard deduction to Rs 100,000,” Surabhi Marwah, Tax Partner, EY India tells TOI.

Chander Talreja, Partner, Vialto Partners says that the basic exemption limit under the new tax regime may be further raised by at least Rs 50,000, which will benefit all individual taxpayers (salaried or non-salaried) opting for the new income tax regime. This will help increase purchasing power of the taxpayers which may further boost the investments.

Aarti Raote, Partner, Deloitte India says raising the basic exemption limit to Rs 5 lakh and introducing the 30% tax rate to the income category of Rs 20 lakh & above as against the existing limit of Rs 15 lakh will give tax relief to all. She also believes that the standard deduction should be increased to Rs 1 lakh from the existing Rs 50,000 limit.

3. New Tax Regime: Benefits for NPS investments

Aarti Raote is of the view that to make the new regime more attractive the government should consider allowing deductions for employee contributions to the NPS within the new tax regime framework.

Vialto’s Chander Talreja notes that the employer’s contribution to the NPS is allowed as a deduction under the new income tax regime. “For the non-salaried individuals, while this deduction is not applicable, they do not even get any deduction for their own contribution. This is a hardship and the government may consider introducing deduction in respect of an individual’s contribution to NPS under section 80CCD(1B), currently capped at Rs 50,000. This will benefit salaried as well as non-salaried individuals,” he tells TOI.

Also Read | Budget 2024 income tax expectations: Raise basic exemption limit, standard deduction and NPS benefits for taxpayers

New Tax Regime: What else can be done?

Preeti Sharma believes that in order to promote savings towards retirement, the government may consider allowing deductions available under section 80C of the Act, under the new tax regime as well.

Aarti Raote says that in line with the government’s agenda of affordable housing and green energy, it is anticipated that specific deductions towards mortgage repayments on affordable housing or electric vehicles be provided under the new tax regime besides incentivizing taxpayers for installation or adoption of solar energy equipment.

However, Kuldip Kumar, Partner at Mainstay Tax Advisors notes that the government has already rationalized the slabs and the rates in its Budget 2023. “I am not expecting that something more would be done except discontinuing the old tax regime whereby by default everyone is in the new regime,” he tells TOI.

Finance Minister Nirmala Sitharaman will present the Union Budget 2024 on July 23, 2024 and personal tax experts are of the opinion that some changes in the new income tax regime can be expected.

What can be done to make the new income tax regime more attractive than the old tax regime, especially for individuals who have done their tax planning based on the old regime? TOI Online Survey of personal tax experts finds out:

Also Check | Budget 2024 Live Updates

New Income Tax Regime: What should change?

All personal tax experts unanimously agree that to make the new income tax more attractive for taxpayers, especially for middle class salaried taxpayers, the government needs to tweak it to introduce more deductions and exemptions.

1. New Tax Regime: Deduction for housing loan

One common deduction that experts believe should make way into the new income tax regime, and one that makes the old tax regime more lucrative for taxpayers, is housing loan deduction.

Preeti Sharma, Partner, Tax & Regulatory Services, BDO India LLP says that currently under the new tax regime, exemption against interest paid on home loan taken for a self-occupied or vacant property is not available. “This provision may be relooked at and be allowed under the new tax regime,” she tells TOI.

Agrees Kuldip Kumar, Partner at Mainstay Tax Advisors, saying, “the deduction for interest on housing loan may be introduced to make it (new tax regime) better for those who still chose the old tax regime.”

Also Read | Income Tax Expectations Budget 2024: What are the ideal new tax regime slabs, rates for middle class, salaried? TOI Online Survey findings

2. New Tax Regime: Hike basic exemption limit, standard deduction

Yet another recommendation is to increase the basic exemption limit and standard deduction under the new regime.

“Increase in the basic exemption limit from Rs 3 to 5 lakhs, raise the standard deduction to Rs 100,000,” Surabhi Marwah, Tax Partner, EY India tells TOI.

Chander Talreja, Partner, Vialto Partners says that the basic exemption limit under the new tax regime may be further raised by at least Rs 50,000, which will benefit all individual taxpayers (salaried or non-salaried) opting for the new income tax regime. This will help increase purchasing power of the taxpayers which may further boost the investments.

Aarti Raote, Partner, Deloitte India says raising the basic exemption limit to Rs 5 lakh and introducing the 30% tax rate to the income category of Rs 20 lakh & above as against the existing limit of Rs 15 lakh will give tax relief to all. She also believes that the standard deduction should be increased to Rs 1 lakh from the existing Rs 50,000 limit.

3. New Tax Regime: Benefits for NPS investments

Aarti Raote is of the view that to make the new regime more attractive the government should consider allowing deductions for employee contributions to the NPS within the new tax regime framework.

Vialto’s Chander Talreja notes that the employer’s contribution to the NPS is allowed as a deduction under the new income tax regime. “For the non-salaried individuals, while this deduction is not applicable, they do not even get any deduction for their own contribution. This is a hardship and the government may consider introducing deduction in respect of an individual’s contribution to NPS under section 80CCD(1B), currently capped at Rs 50,000. This will benefit salaried as well as non-salaried individuals,” he tells TOI.

Also Read | Budget 2024 income tax expectations: Raise basic exemption limit, standard deduction and NPS benefits for taxpayers

New Tax Regime: What else can be done?

Preeti Sharma believes that in order to promote savings towards retirement, the government may consider allowing deductions available under section 80C of the Act, under the new tax regime as well.

Aarti Raote says that in line with the government’s agenda of affordable housing and green energy, it is anticipated that specific deductions towards mortgage repayments on affordable housing or electric vehicles be provided under the new tax regime besides incentivizing taxpayers for installation or adoption of solar energy equipment.

However, Kuldip Kumar, Partner at Mainstay Tax Advisors notes that the government has already rationalized the slabs and the rates in its Budget 2023. “I am not expecting that something more would be done except discontinuing the old tax regime whereby by default everyone is in the new regime,” he tells TOI.