NEW DELHI: Gautam Adani and his conglomerate, the Adani Group, are at the center of a major legal and financial storm following an indictment by US prosecutors. The charges allege that Adani, his nephew Sagar Adani, and other associates orchestrated a $265 million bribery scheme to secure lucrative solar energy contracts in India. Between 2020 and 2024, the accused reportedly bribed Indian officials to gain business advantages while misleading US investors and financial institutions about their anti-corruption practices.

The charges against Adani and others have been filed in the US District Court for the Eastern District of New York, a prominent federal court known for handling high-profile cases involving corporate fraud, securities violations, and international corruption. This court, based in Brooklyn, has jurisdiction over cases that involve violations of US federal law, especially those with connections to international financial systems and foreign bribery under the Foreign Corrupt Practices Act (FCPA).

The prosecution is led by the US Attorney for the Eastern District of New York, Breon Peace, who oversees cases related to white-collar crimes, organized fraud, and cross-border offenses.

Why US authorities took action

The US indictment stems from the involvement of American investors and financial markets in the alleged fraud. Under the Foreign Corrupt Practices Act (FCPA), US law prohibits companies from bribing foreign officials if their activities involve US financial systems or investors.

In this case: Funds were raised from US investors and allegations pointed to fraudulent disclosures made in connection with securities offerings.

Here is all you need to know about:

1. What are the main allegations against Gautam Adani and the Adani Group?

US prosecutors have charged Gautam Adani, his nephew Sagar Adani, and others with a $265 million bribery scheme to secure solar energy contracts in India. The indictment alleges that Adani Group executives paid bribes to Indian government officials between 2020 and 2024 and concealed these activities from US investors. The charges include securities fraud, wire fraud conspiracy, and misleading investors about anti-corruption practices.

2. How did the alleged bribery scheme operate?

The indictment details that executives used encrypted communication, mobile tracking, and coded language to discuss and execute the bribery plan. Bribes were calculated at approximately $30,000 per megawatt for solar projects and disguised as “development fees.” In some instances, Azure Power, a related company, transferred projects to Adani Green Energy as part of the bribery scheme.

3. What are the financial implications of the indictment on Adani Group companies?

The charges have triggered a massive sell-off in Adani Group stocks, with the conglomerate losing about $27 billion in market value. Shares of Adani Enterprises fell by 23%, and Adani Green Energy declined by 19%. The group also canceled a $600 million bond offering due to the negative market reaction.

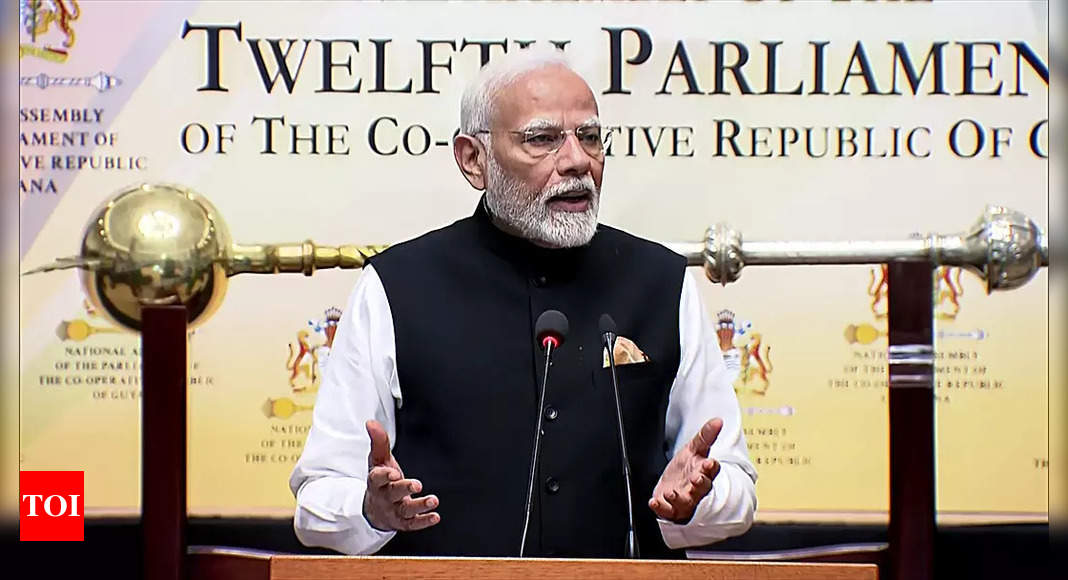

4. What is the political fallout from these allegations in India?

The indictment has intensified political tensions. Opposition leaders, including Rahul Gandhi, have called for Adani’s arrest and an investigation into his alleged ties with Prime Minister Narendra Modi. Critics argue the case underscores a broader issue of corruption and favoritism within the Indian government, though the BJP denies these claims and emphasizes legal processes should take their course.

5. What is the Adani Group’s response to the charges?

The Adani Group has denied the allegations, calling them “baseless” and politically motivated. A group statement emphasized its commitment to governance, transparency, and regulatory compliance, asserting that it would seek all possible legal recourse to contest the charges.

6. How were US federal authorities involved in the investigation?

The US investigation included the FBI seizing electronic evidence from Sagar Adani in 2023 and uncovering extensive documentation of the bribery scheme, including PowerPoint presentations and encrypted communications. The US authorities have also issued arrest warrants for Gautam and Sagar Adani.

7. What are the international implications of this case?

This case has highlighted cross-border enforcement of anti-corruption laws, particularly the US Foreign Corrupt Practices Act (FCPA). It also affects international investor confidence in Indian conglomerates, with Adani’s global reputation and access to capital markets now under significant scrutiny.

8. How does this relate to previous allegations against Adani Group?

The Adani Group faced similar scrutiny in 2023 when Hindenburg Research accused it of stock price manipulation and improper use of tax havens. While the group denied those allegations, the current indictment adds legal weight to concerns about its business practices.

9. What role does Azure Power play in this case?

Azure Power, formerly listed on the New York Stock Exchange, is implicated as a co-conspirator. Executives from Azure allegedly collaborated with Adani executives to plan and facilitate bribes. Azure has since stated that individuals named in the indictment are no longer associated with the company.

10. What’s next for Gautam Adani and the Adani Group?

Legal experts suggest Adani could pursue dismissal of the indictment or negotiate a settlement with US authorities. Meanwhile, Indian authorities may face pressure to initiate their investigations. Market analysts predict continued volatility in Adani Group stocks as the case unfolds.

(With inputs from others)