NEW DELHI: The Centre has circulated a draft legislation to ban lending by unregulated entities, including by platforms, with violators facing imprisonment of up to seven years. Lenders, who harass and use unlawful means for recovery, face up to 10 years in jail, with those promoting such lending facing a term of up to five years.

The move comes amid several complaints of borrowers taking loans from digital lending platforms, including those operated by Chinese entities, at exorbitant rates. And these platforms often harass customers by blackmailing them in case of defaults. There have been instances of borrowers committing suicides due to harassment, prompting the Centre and the regulator to step in.

The plan is to notify certain activities as “unregulated lending” with a “competent authority” tasked with regulating the segment and also maintain a database on lenders. The authority headed by a secretary-rank officer will have powers to provisionally attach the accounts of the lender and call for data. All information received by the agency will have to be shared with CBI or state police.

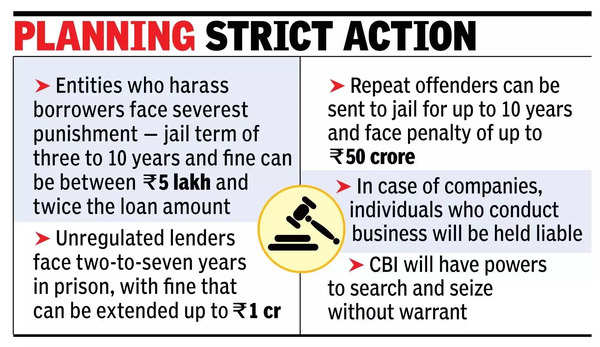

Anyone, including banks and NBFCs, with information on unlawful lending has to alert authorities. Offences under the proposed law will be cognizable and non-bailable, the draft said. The severest punishment is reserved for those who harass borrowers – with jail term of three to 10 years and fine can be between Rs 5 lakh and twice the loan amount. Unregulated lenders face two-to-seven years in prison, with fine that can extended up to Rs 1 crore. Repeat offenders can be sent to jail for up to 10 years and face penalty of up to Rs 50 crore. In case of companies, individuals who conduct business will be held liable.

CBI will enjoy powers to search and seize without warrant. The draft, based on recommendations by a panel of RBI, has been circulated by finance ministry for consultation bt stakeholders.

“The mushrooming of lending platforms, which offer quick, unsecured loans mostly for frivolous consumptions, without adequate credit check, has the potential for putting Indian households at a massive systemic risk. Regulators have raised several alarms on the burgeoning household debt levels. Further, these lending platforms are not most transparent in levying financing charges. Thus, this legislation is extremely timely, with the intent to put in place mechanisms of ethical and regulated lending, backed by proper credit appraisals,” said Soumitra Majumdar, partner at JSA Advocates & Solicitors.