Stock market crash today: BSE Sensex and Nifty50, the Indian equity benchmark indices, crashed in trade on Tuesday. While BSE Sensex went below the 81,000 level, Nifty50 was just above 24,300. BSE Sensex ended the day at 80,684.45, down 1,064 points or 1.30%. Nifty50 closed at 24,336.00, down 332 points or 1.35%.

Index heavyweights Reliance Industries, Infosys, and HDFC Bank led the stock market crash as investors exercised caution before the US Federal Reserve’s December 18 meeting regarding rate cut signals.

The total market value of BSE-listed companies decreased by Rs 2.33 lakh crore to Rs 257.73 lakh crore, according to an ET report.

Among Sensex constituents, the primary contributors to the decline were Reliance Industries, HDFC Bank, Infosys, Bharti Airtel, and ICICI Bank. Conversely, Tata Motors, Adani Ports, Tech Mahindra, HUL, HCL Tech, and Power Grid showed positive movement.

Why BSE Sensex, Nifty50 crashed today

1) Pre-Fed meeting uncertainty

Investors displayed caution before tomorrow’s Federal Reserve policy meeting, which is anticipated to provide direction on interest rate reductions.

The CME FedWatch tool indicates a 97% likelihood of a 25 basis-point rate reduction on Wednesday. However, uncertainty persists regarding the Fed’s 2025 rate strategy due to recent US data showing sustained inflation and economic resilience.

“Globally, markets will be looking forward to the FOMC outcome on Wednesday. Markets have already priced in a 25bp rate cut, so the focus will be on the Fed chief’s commentary. Any departure from dovish commentary will be negative from the market’s perspective,” said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

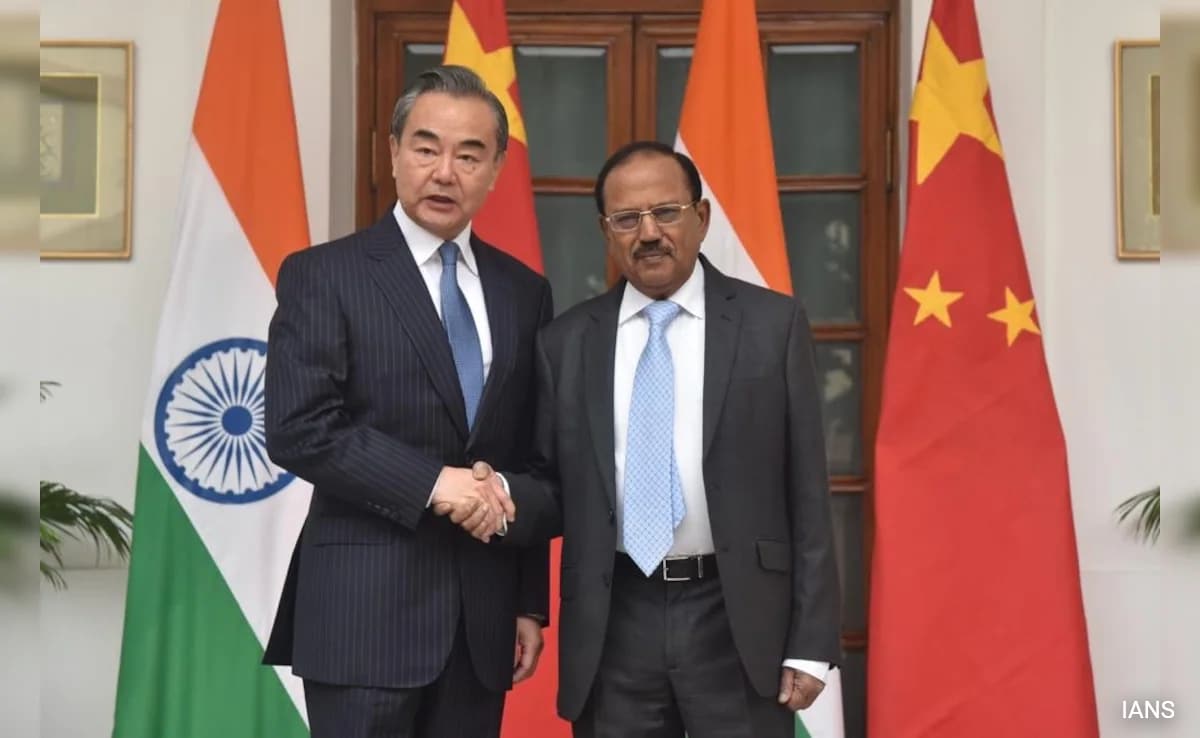

2) Chinese economic slowdown

November data revealed slower-than-expected Chinese consumption. Retail sales increased by only 3%, significantly lower than October’s 4.8%, while industrial production grew 5.4% year-on-year, matching October’s figures. This deceleration could affect global commodity demand, particularly impacting India’s metals, energy, and automotive sectors.

The Nifty Metal and Auto sectors declined by over 0.6% in today’s trading.

3) Dollar strength

The dollar index remained stable at 106.77, heading towards a 5% annual increase. A stronger dollar reduces international investor interest in Indian equities and increases dollar-denominated debt costs for Indian firms.

4) Increased trade deficit

India’s November merchandise trade deficit reached a record Rs 37.84 billion, increasing from October’s Rs 27.1 billion, due to higher imports and reduced exports.

“The sharp spike in India’s trade deficit to $37.8 billion in November will put pressure on the rupee, pushing it towards 85 to the dollar. Exporters, like IT and pharma, will benefit from a depreciating rupee, but for importers, the increased import cost will impact their stock prices,” said Vijayakumar.

5) International market trends

Indian markets followed global counterparts downward as investors anticipated central bank meetings. While the US Federal Reserve may reduce rates, the Bank of Japan is expected to maintain current policies.

The MSCI Asia-Pacific index (excluding Japan) decreased 0.3%. Japan’s Nikkei fell 0.15%, whilst European futures indicated subdued openings. Eurostoxx 50 futures dropped 0.16%, German DAX futures declined 0.06%, and FTSE futures weakened by 0.24%.