NEW DELHI: India’s entertainment and media industry is projected to grow at a combined annual growth rate (CAGR) of 8.3 per cent to hit Rs 365,000 Crore (USD 19.2 billion) outpacing the global rate of 4.6 per cent, according to PwC India’s report “Global Entertainment and Media Outlook 2024-28: India perspective”.

Currently, the US leads the global market by revenue, with China in the 2nd place and India at the 9th.

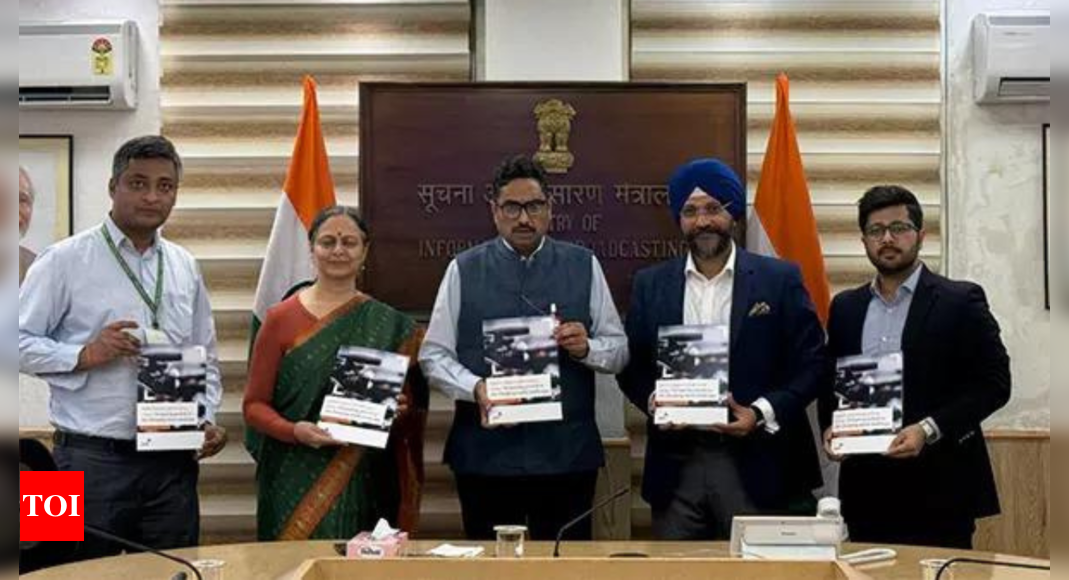

Manpreet Singh Ahuja, Chief Digital Officer and TMT Leader at PwC India said India’s Entertainment and Media sector is on the cusp of a major transformation.

According to the multinational consulting services company, key growth drivers such as digital advertising, OTT platforms, online gaming, and Generative AI are shaping the future of the industry.

Ahuja said that these rapidly expanding segments are positioning India as a global leader in innovation and growth.

“Businesses that adapt and innovate in these areas are poised to seize unparalleled opportunities in this dynamic landscape,” Ahuja added.

With India’s improved connectivity, rising advertising revenues and favourable Government policies around foreign direct investment (FDI), the country is predicted to see one of the highest growth rates in the next five years.

The country’s large millennial and Gen-Z population base of over 91 crore has access to the world’s cheapest data costs. At present, India has 80 crore broadband subscriptions, 55 crore smartphone users and 78 crore internet users.

With growing consumption and gross domestic product (GDP) growth in India, the advertising market is projected to grow at a 9.4 per cent CAGR from Rs 101,000 crore in 2023 to Rs 158,000 crore in 2028, which is 1.4x the global average.

Most of this growth, PWC said, will come from digital front (internet advertising), which is expected to grow at a 15.6 per cent CAGR, rising from Rs 41,000 crore in 2023 to Rs 85,000 crore in 2028.

Internet advertising’s year-on-year growth, which was 26.0 per cent in 2023, will remain in double digits throughout the forecast period (2024-28), and is expected to be 12.2 per cent in 2028.

This shift towards cord-cutting is expected to accelerate. Traditional TV advertising will grow at a 4.2 per cent CAGR between 2023 to 2028, while global revenues are set to drop by (-) 1.6 per cent. India is poised to become the fourth-largest TV advertising market by 2026.