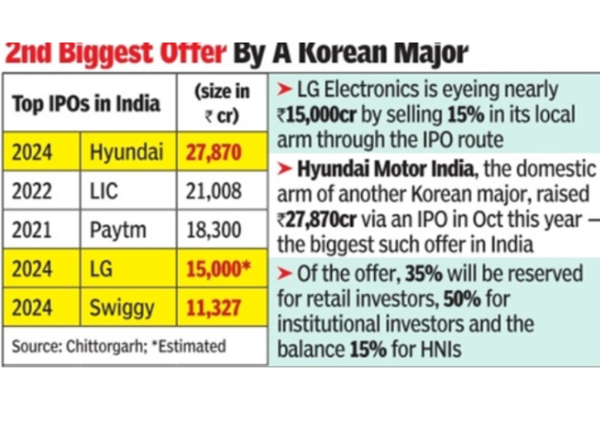

MUMBAI: After Korean carmaker Hyundai, it is now the turn of compatriot and popular consumer electronics giant LG to tap Indian capital markets.

LG Electronics, the global electronics giant, is eyeing to mobilise an estimated Rs 15,000 crore by selling a 15% stake in LG Electronics India through the IPO route. On Friday, the Indian company filed its offer documents with markets regulator Sebi. The Korean parent — which has been in India for over three decades — is proposing to sell nearly 10.2 crore shares through the offer, IPO papers showed.

It’s a complete offer for sale, like the IPO for Hyundai Motor India — the domestic arm of another Korean major in the automobile space. Through the OFS for Hyundai Motor India in Oct this year, its Korean parent raised Rs 27,870 crore, making it the biggest such offer in India.

According to Sebi rules, 35% of the offer will be reserved for retail investors, 50% for institutional investors and the balance 15% for noninstitutional investors (high net worth investors), the draft offer document showed.

In India, LG — which set up its business here about 27 years ago — is one of the leading white goods companies with a strong presence in ca tegories like washing machines, refrigerators, panel televisions, inverter air conditioners and microwaves. It’s been the number one player in this industry for 13 consecutive years (2011-23) according to the value market share in the offline channel in India, a report by Redseer showed.

Morgan Stanley India, Axis Capital, J P Morgan India, BofA Securities India and Citigroup Global Markets India are the lead managers to the LG Electronics offer.