MUMBAI: Domestic tyre maker Ceat, an RPG-Harsh Goenka group company, will acquire Camso brand that has an off-highway tyre business from global major Michelin for $225 million, translating to about Rs 1,900 crore. Under the deal, Ceat will also acquire two Sri Lanka-based manufacturing facilities from Michelin, a French tyre maker.

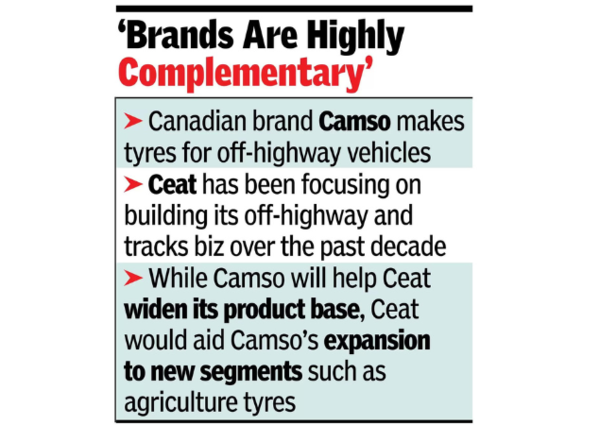

Camso is a Canadian brand that makes tyres for tractors, harvesters, bulldozers and other off-highway vehicles which command higher margins compared to tyres for passenger vehicles and two wheelers. Michelin had in 2018 acquired the brand for nearly $1.5 billion.

“The Camso brand is an excellent fit with the growth strategy of Ceat’s off-highway tyre business, thereby improving our margin profile,” Arnab Banerjee, MD & CEO at Ceat, was quoted as saying in a company release.

Over the last decade, Ceat has been focusing on building its off-highway and tracks (OHT) business, which now consists of over 900 product offerings and covers around 84% of the range requirement in the agricultural segment, the release said. Camso will give Ceat the ability to widen its product base into tracks and construction tyres. The acquisition will give Ceat access to a global customer base including over 40 international original equipment manufacturers and premium international OHT distributors. “Ceat brings in the ability for Camso to expand to other segments such as agriculture tyres. Both brands are highly complementary in their positioning and capabilities,” a Ceat release said.

Ceat is one of India’s leading tyre companies that manufactures tyres for passenger cars, two-wheelers, trucks, buses, light commercial vehicles and off-highway vehicles. It caters to leading OEMs as well as domestic and international markets, exporting to 110+ countries, the release from the company said. Camso, meanwhile, is one of the leaders in the OHT market. Ceat and Camso together could have the synergies to expand to other segments such as agriculture tyres. In Friday’s relatively flat session, Ceat’s stock on BSE closed a marginal 0.2% up at Rs 3,092.