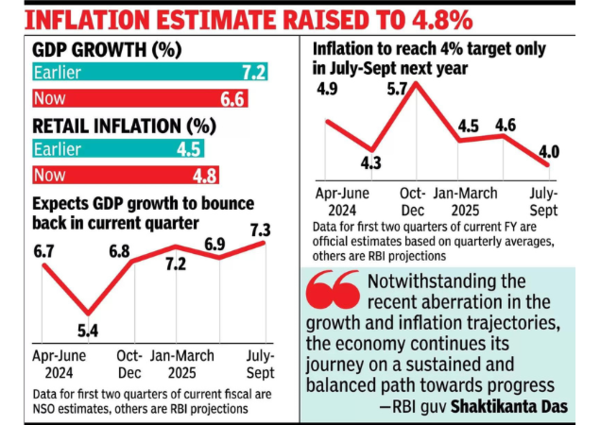

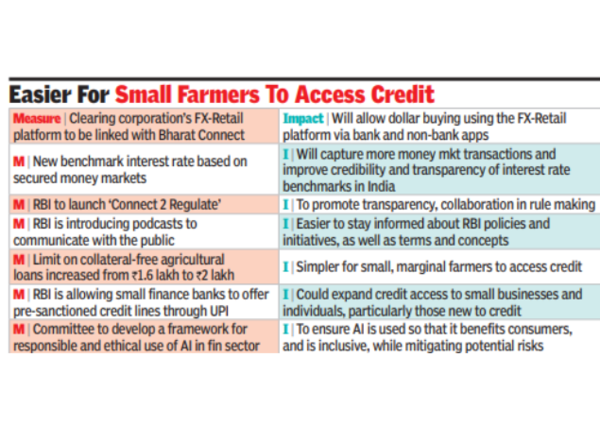

MUMBAI: Reserve Bank of India (RBI) on Friday kept the policy rate unchanged for the 11th consecutive time at 6.5%, cut the economic growth forecast to 6.6% for 2024-25 from the earlier 7.2%, and reduced the cash reserve ratio (CRR) by 50 basis to 4%, which is expected to release nearly 1.6 lakh crore for banks and help moderate lending rates.

The sharp reduction in the GDP growth forecast comes against the backdrop of the slowdown in economic growth for the second quarter, which slumped to a seven-quarter low of 5.4%. RBI also raised the inflation projection for FY25 to 4.8% from 4.5%.

“Since the last policy, inflation has been on the upside, while there has been a moderation in growth. Accordingly, the MPC has adopted a prudent and cautious approach in this meeting to wait for better visibility on the growth and inflation outlook. At such a critical juncture, prudence, practicality and timing of decisions become even more critical,” RBI governor Shaktikanta Das said in a statement after the meeting of the monetary policy committee.

The monetary policy committee meeting saw two members voting for a rate cut while four others backed status quo

CRR refers to the portion of deposits that are impounded with RBI to maintain a liquidity buffer and control money supply. The CRR cut will happen in two phases in the second half of December. CRR was earlier hiked to 4.5% in May 2022 following market volatility triggered by Russia’s invasion of Ukraine.

Das said growth is expected to gather pace in the quarters ahead. Das said growth is expected to gather pace in the quarters ahead. “Going forward, high frequency indicators available so far suggest that the slowdown in domestic economic activity bottomed out in Q2:2024-25 and has since recovered, aided by a strong festive demand and pick-up in rural activities. Agricultural growth is supported by healthy kharif crop production, higher reservoir levels and better rabi sowing. Industrial activity is expected to normalise and recover from the lows of the previous quarter,” said Das.

Expectations of a rate cut had brightened after growth slumped to near-two-year low in the July-Sept quarter and there have been growing calls for reducing the rates against the backdrop of a slowdown in urban consumption due to stubborn inflationary pressures largely led by food. Before starting his formal monetary policy statement, Das strongly defended inflation targeting and the monetary policy framework.

There have been calls from senior ministers in government to cut rates and they have indicated that central bank should not be swayed by high food inflation, which they attributed to supply side and weather-related issues. “We are in regular discussion with the govt regarding inflation and supply side issues. RBI Act requires us to target headline inflation, we cannot use our discretion to target core, food, or fuel inflation. The target of headline inflation is enshrined in law,” Das said.