NEW DELHI: The revival of Air India, “the Everest of corporate turnarounds”, is “not a T20 match but a five-day one currently at lunch on day three”. That’s how Air India MD & CEO Campbell Wilson on Thursday described the Tata Group‘s mammoth task at hand with the Maharaja, weeks after merging erstwhile Vistara and AirAsia India into AI and AI Express, respectively.

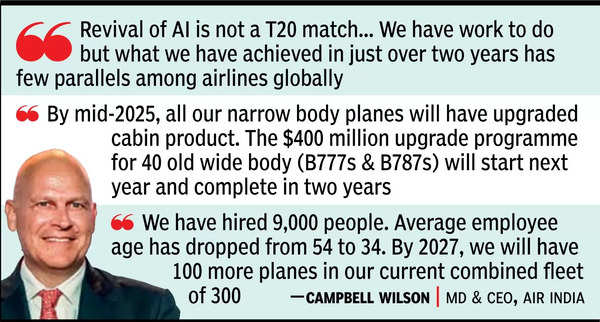

Amid continuing poor cabin product, flight delays and integration issues, the veteran from Singapore Airlines admitted, “We have work to do but what we have achieved in just over two years has few parallels among airlines globally.” While passengers on costly but delayed intercontinental flights with broken seats have begun questioning the pace of change, reviving AI, which saw no investment in its last few years as a cash-strapped PSU, is an uphill task.

Crippling global supply chain constraints are leading to longer than expected waits for inducting new planes. This has made the task of revamping old legacy fleet more difficult, despite Tatas spending billions of dollars on getting JRD’s baby back into shape.

Asked if AI had bitten off more than it could chew in its current state, Wilson said: “The health of (AI’s legacy planes, especially wide bodies) is not as good as we would like it to be. Coupled with weather and airspace issues, when even one factor causes a delay, it takes a while to catch up. There are (less than required) non-stops to North America but no wide body aircraft are available globally as of now. We had an opportunity to lease some of these planes (to add flights). There is a demand to travel. Had we not taken these planes and added flights, there would have been a long wait to do so. Yes, we wish (the wide body non-stops) were more smooth (on-time).” AI has 51 weekly non-stops to North America.

While that remains work in progress, AI has been more successful in some other tasks. The average age of cabin crew has now dropped to 28 from earlier 40s in AI’s state-owned days. “We have hired 9,000 people. The average employee age has dropped from 54 to 34. By 2027, we will have 100 more planes in our current combined fleet of 300,” Wilson said.

Most of the aircraft coming over the next few months will be narrow body and then wide body will be taken out of service for revamping. So, the growth will come mainly from domestic and nearby international sectors for about one-two years. When revamped old wide bodies and new ones join the fleet, this segment will grow.