MUMBAI: Sensex rallied to close 2,000 points or 2.5% higher on Friday at 79,117 on the back of a strong Wall Street close on Thursday night and short covering by local speculators during closing hours. While Reliance Industries, Infosys and ICICI Bank contributed the most to the sensex’s gains, all 30 of its constituents closed higher too, a rare occurrence. On the NSE, Nifty rallied 557 points or 2.4% to close at 23,907 points.

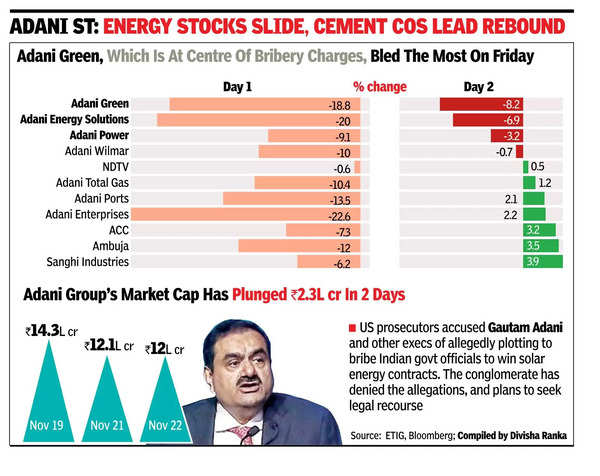

The stocks of Adani Group companies had a mixed closing on Friday, although they lost some more value in market cap on a net basis from Thursday’s close.

The day’s rally added about Rs 7.3 lakh crore to investors’ wealth, with BSE’s market capitalisation now at Rs 441 lakh crore. However, market players are not convinced that the rally could sustain.

Benchmark indexes surged more than 2% due to short covering ahead of the weekend, said Joseph Thomas, Head of Research, Emkay Wealth Management. “There is little more than just short covering in this massive uptick as some of the major market participants expressed positive views on the market supported by buying in the banking stocks. Despite this up move, it remains to be seen to what extent the current momentum is going to be sustained next week.”

According to Thomas, the ongoing Russia-Ukraine conflict, the volatile geo-political situation in West Asia, state election results for Maharashtra and Jharkhand, are the factors that may have some impact on the markets in the coming week.

The day’s session saw a mixed trend in Adani group’s stocks. The stock price of group flagship Adani Enterprises went up by 2.2% and in the process recovered only a small part of its 22% loss the previous session. Stock prices of both the cement majors – Ambuja Cements and ACC – closed higher, along with Adani Ports & SEZ and Adani Total Gas.

Among the laggards were Adani Green Energy that crashed another 8.2% on Friday, while Adani Energy Solutions lost another 6.9%.

At the market cap level, the group’s total value was down about Rs 10,300 crore to just a tad below the Rs 12 lakh crore mark. In Friday’s session, foreign funds continued to be sellers with the day’s net outflow at Rs 1,278 crore. In contrast, domestic funds were net buyers at Rs 1,722 crore, BSE data showed.