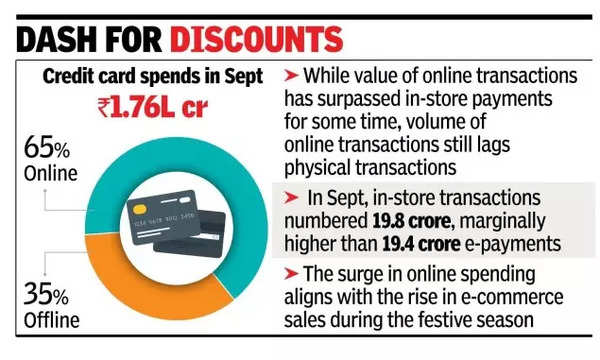

MUMBAI: Online spends through credit cards have continued to surge driven by e-commerce discounts. In September 2024, credit card users spent Rs 1,15,168 crore online, accounting for 65.4% of the total Rs 1,76,201-crore card spends, official data showed.

In other words, for every one rupee spent by swiping credit cards at a point-of-sale machine, two rupees were spent online. In April, online spends were at Rs 94,516 crore, making up 60% of the total Rs 1,56,498 crore. The share of online spending rose to 63.4% in July, dipped slightly to 62.4% in August, and reached 65.3% in September bolstered by online sales.

While the value of online transactions has surpassed in-store payments for some time, volume of online transactions still lags physical transactions. In September, in-store transactions numbered 19.8 crore, marginally higher than 19.4-crore online payments. In April, offline transactions were 18.4 crore compared to 15.9 crore online. The surge in online spending aligns with the rise in e-commerce sales during the festive season, which began in September.

Datum Intelligence estimated that e-commerce sales in Sept and Oct reached about $12 billion, up 23% from last year, driven by sales at e-commerce platforms like Flipkart and Amazon, where online sales rose 26%, led by mobile phones and electronics. In quick-commerce, online card spends are growing 74% year-on-year, according to Datum – taking business away from kirana stores.

The growth in online payments is also supported by rising utility payments. In Q2 FY25, there were 62.7 crore online bill payments worth Rs 2,38,897 crore, up from 45.6 crore transactions totalling Rs 1,23,345 crore in Q1. The NPCI Bharat Bill Payment data however includes payments made through UPI and debit cards.

A survey by Paisabazaar on festive shopping trends among 700 credit card users showed a preference for online purchases due to card-specific offers and convenience. Of the respondents, 45% were from tier-1 metros, 68% were salaried employees, and 76% were under 35 years old. The survey revealed that 80% of users found more value in online shopping during the festive season; 48% shopped exclusively online, while 45% combined online and in-store shopping.

Only 7% preferred in-store shopping. Around 80% of users utilised credit card offers on e-commerce platforms, with 85% planning their shopping around these sales events, driven by discounts, no-cost EMI options, and better deals.