MUMBAI: Insurance regulator Irdai’s chief has made a case for increasing foreign direct investment in the insurance industry to 100% to achieve the goal of ‘insurance for all’ by 2047.

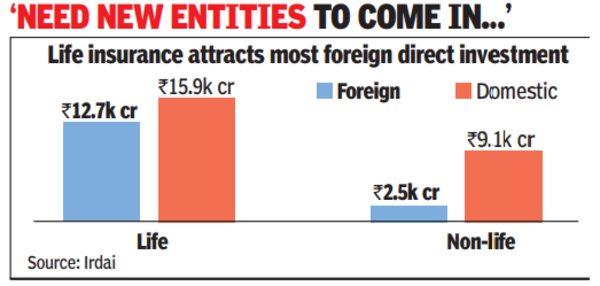

“Perhaps it’s time to open up for 100% FDI so more players who want to come and operate on their own terms without trying to look for an Indian partner. But if somebody comes with 74:26 also, it’s fine,” Debashish Panda, chairman of Insurance Regulatory and Development Authority (Irdai), said. “When we are talking of insurance for all by 2047, obviously, we need a lot of capital. Insurance is a capital-intensive sector. Which means we need a lot of new entities to come in. There may be some consolidation also happening. If FDI rule is also open, that will only augment the domestic investment as well,” he added.

The Irdai chief was speaking at a BFSI summit organised by the Business Standard. While the regulator has proposed increasing FDI limits, the decision will be govt’s as the limits are part of the Insurance Act. Earlier, Irdai had also proposed allowing insurance companies that do composite (life as well as non-life business). This proposal requires legislative amendments too.

“Govt has taken up this and some of the other recommendations which we’ve made and as and when the Act gets amended, it should open the way for a composite licence,” Panda said.

Govt has already allowed 100% FDI for insurance intermediaries and has permitted foreign reinsurance branches to increase domestic capacity. The FDI limit in insurance was hiked from 49% to 74% after finance minister Nirmala Sitharaman announced it in the union Budget for 2021-22. The Budget was followed by an amendment to the insurance act, thus making this possible. However, under the new regime, the majority of directors on the board and key management persons must be resident Indians, with at least 50% of directors being independent directors, and a specified percentage of profits being retained as general reserve.

Panda said that Irdai is looking to open the door for more domestic reinsurers to set up shop in India. They have received one application for a domestic reinsurer which is currently under process. Irdai is also looking to attract big investors – including those already operating in the primary insurance space – to enter the reinsurance business in India. Panda said that the creation of reinsurance capacity is a priority for Irdai, and that the new regulations are aimed at facilitating this in the near future.