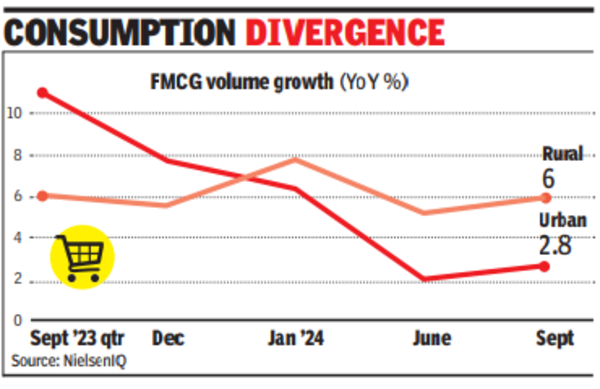

MUMBAI: Rural consumption of FMCG products like atta and soap, driven by a good monsoon season, grew at more than double the pace of urban in the Sept quarter, where middle class people have curtailed expenses due to high food inflation.

The fast moving consumer goods (FMCG) industry recorded a volume growth of 2.8% in urban regions in the Sept quarter – this compares with a growth of 11% seen in the year-ago quarter and only a marginal improvement from the 2.1% growth recorded in the June quarter, data released by NielsenIQ on Thursday showed. Rural consumption grew 6% in Q3 from 5.2% in Q2. “Rural areas continue to surpass urban areas in volume growth across most regions of India,” analysts at the consumer intelligence firm said.

The FMCG sector grew 5.7% by value and 4.1% in volume in Q3. Analysts tracking the sector said that a bountiful monsoon is expected to have translated into better incomes, helping rural consumption. Besides, festivals in the quarter like Raksha Bandhan and Onam also fuelled some spending, reflected in the growth of food consumption which increased to 3.4% in Q3 from 2.1% in Q2.

“The uptick in volume growth is attributed to staple categories – edible oils, packaged atta and spices – despite price growth. Small manufacturers recovered from consumption decline of last three quarters and grew faster than giants… this is led by sharp recovery in volume growth in food for small players,” NIQ said.

In urban India, most FMCG companies try to push premium packs and high food inflation may have dented sales volumes of high-priced packs, said independent consumer consultant Akshay D’souza. “All big FMCG firms like Nestle and Dabur have been expanding their rural coverage which has also added to growth in the regions,” D’souza added.

In recent earnings calls, companies have flagged weak urban demand. Within urban, the lower middle class and bottom-of-the-pyramid segments have been impacted the most, although govt schemes have partly helped in insulating some segments from the impact of food inflation. “In big cities, there is a trending down of growth… let’s not forget that urban has been driving the engine of the FMCG industry for the last several quarters, they are operating on high base and some normalisation is expected,” Rohit Jawa, CEO & MD at HUL, said last month.

Companies like HUL, Marico, Dabur and Tata Consumer Products have started taking price hikes on the back of commodity inflation and it needs to be seen how consumption plays out in the coming quarters.