MUMBAI: Reliance is doing a Jio with Campa Cola. The brand’s disruptive pricing has beverage giants PepsiCo and Coca-Cola on tenterhooks.

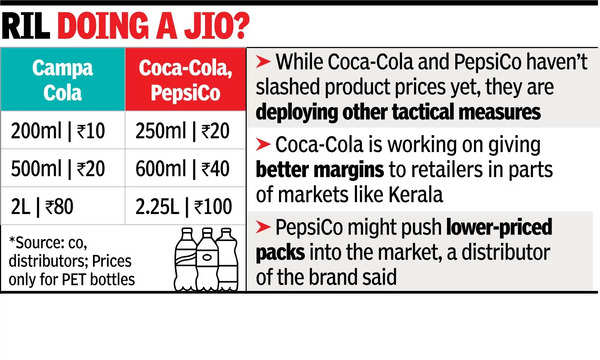

Campa Cola has priced its 200 ml bottles at Rs 10, lower than Coca-Cola and PepsiCo’s pricing of Rs 20 for 250 ml (comparison only for PET bottles as Campa has those). For almost all pack sizes, Campa Cola is offering lower rates to consumers with a differential of Rs 10-20.

Coca-Cola and PepsiCo have not slashed prices of their products as of now but are deploying other tactical measures on the ground, distributors of the brands in parts of South and East India told TOI.

Coca-Cola, for instance, is working towards giving better margins to retailers in parts of markets like Kerala. “Retailers will only promote those brands for which they get good margins. Usually, Coca-Cola used to offer 2.5 litre bottles (MRP is Rs 100) to retailers at Rs 75. But this time, before Onam, they reduced it to Rs 65. This seems to be due to the entry of Campa in the market,” Coca-Cola distributor based in Kerala said. Retailer margin is essentially the difference between the price a retailer pays for a product and the price at which they sell it to consumers.

PepsiCo, on the other hand, might push lower-priced packs into the market, a distributor of the brand said. In fact, in a recent earnings call, PepsiCo’s India bottling partner Varun Beverages said that if the market situation warrants, they will come up with a range that can “fight” Campa’s pricing.

“Reliance is carrying out vigorous promotional activities on the ground for Campa and aggressively trying to get distributors. They want to do the same thing they did with Jio,” the distributors said. Coca-Cola and Reliance did not respond to queries while PepsiCo declined to comment.

In parts of the Eastern markets such as Kolkata, Campa is going “overboard” on marketing besides offering cost subsidies to distributors. In the East at least, Campa is targeting price-sensitive pockets to gain foothold.

“The price points of Campa are making an impact on the ground. Coca-Cola and Pepsi have lost some market share in West Bengal. Our estimates suggest that Campa has gained a 2% market share in the non-alcoholic beverage segment in the region,” a Coca-Cola distributor based in the Eastern region said, adding that it needs to be seen how Campa sustains such a pricing strategy in the long run.