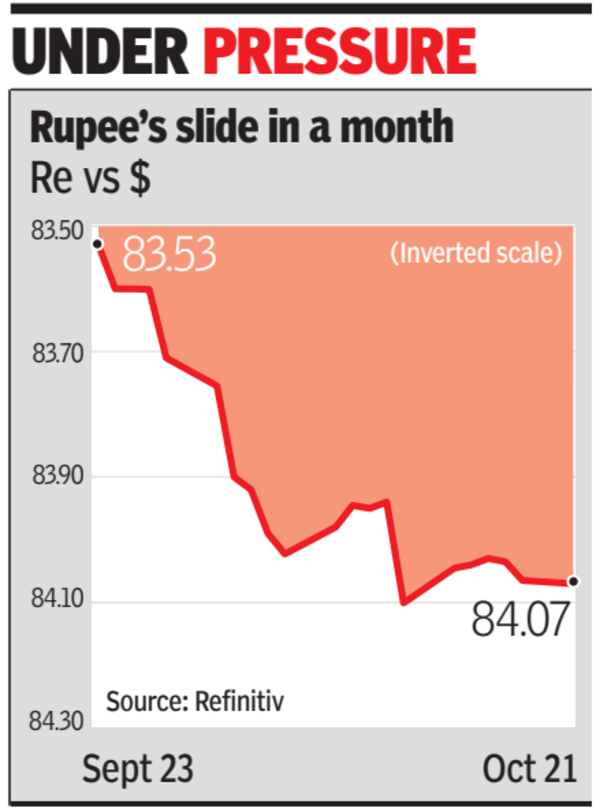

MUMBAI: The rupee fell to a record closing low of 84.07 against the dollar on Monday. This was marginally lower than Friday’s close of 84.06 on the back of gains in the dollar index and dollar sales by foreign portfolio investors.

FPIs have sold shares worth nearly $10 billion in October, according to NSDL data. Benchmark indices continued to be in the red on Monday, with the sensex closing 73 points lower at 81,151 and Nifty ending 73 points down too at 24,781.

The rupee has been under pressure in recent weeks with RBI dipping into its reserves to meet the dollar demand. RBI is well-positioned to defend the currency, with forex reserves close to $700 billion. It sold $6.5 billion net in the spot foreign exchange market in Aug after purchasing $6.9 billion in July, data in the central banks’ monthly bulletin said.

In international markets, the dollar and gold gained over uncertainty of the outcome of US elections. The reduction in interest rates by China’s central bank continued to fuel the ‘sell India, buy China’ strategy among foreign investors.

“The rupee traded slightly weak near 84.07, as the dollar index gained from 103.20$ to 103.50$. The major weakness in the rupee stemmed from a downturn in capital markets, with broad-based selling observed in Indian markets. FPIs were net sellers, offloading over Rs 5,000 crore in cash on Friday, adding pressure on the rupee,” Jateen Trivedi, research analyst with LKP Securities, said.

RBI’s net outstanding forward dollar sales were nearly $19 billion at the end of Aug, up from $9.1 billion in July. Dealers said that public sector banks sold dollars on Monday on behalf of RBI, while foreign banks, serving as custodians for foreign investors, bought the greenback.