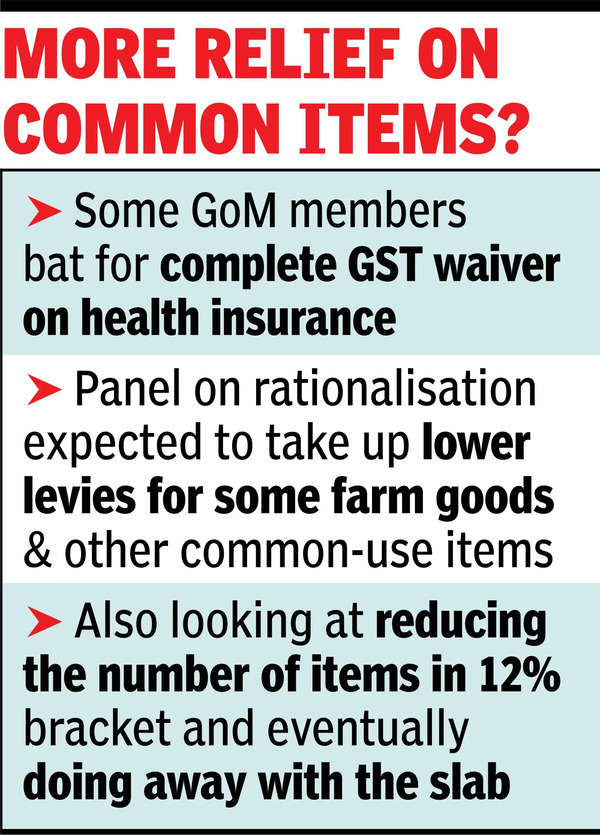

NEW DELHI: A group of state finance ministers is veering towards GST exemption on term insurance plans, while also considering removal of the levy for senior citizens purchasing health insurance and for those who buy medical coverage of up to Rs 5 lakh.

A second group of ministers (GoM) is looking at ways to minimise revenue loss to the exchequer by increasing the levy to 28% on ‘luxury’ goods such as watches costing more than Rs 25,000 and shoes costing over Rs 15,000, while lowering GST on common-use items such as notebooks (12%), bicycles of less than Rs 10,000, and drinking water sold in 20+ litre containers and aerated water (now at 18%).Shoes that cost more than Rs 1,000 and watches currently face 18% levy, and the high-end versions could see the burden rise to 28%.

Panels mull higher GST slabs for ‘luxury’ items

Footwear costing up to Rs 1,000 attracts 12% GST.

The two ministerial panels — on insurance and rationalisation — headed by Bihar deputy CM Samrat Chaudhary, with state finance ministers representing the entire political spectrum as members, are hoping to garner Rs 22,000 crore through these higher levies. The two group of ministers met in the capital Saturday but are yet to firm up their final recommendations.

More deliberations will be needed before the recommendations are sent to GST Council, a panel led by finance minister Nirmala Sitharaman, to take the final call, one of the state finance ministers said.

With crucial state elections ensuing, the ministers will not decide in a rush and the work being done by a third group of ministers, led by Sitharaman’s deputy Pankaj Chaudhury, on the future roadmap for compensation cess will be taken on board and a comprehensive package will be worked out, given that most states are keen on ensuring that their revenues are not adversely impacted. “Not many items were discussed today. Any decision will require a detailed analysis and consultation,” a state FM said after the rate rationalisation panel met on Saturday.

The group of ministers on insurance received multiple suggestions with some panel members suggesting that GST on health insurance should be completely waived. Tamil Nadu FM Thangam Thennarasu suggested 5% GST but without input tax credit. Currently, insurance policies attract 18% tax, the same as other common use services such as telecom or banking.

Exemption from GST is fraught with the threat of breaking the chain, which will result in suppliers to companies selling life and health insurance getting no tax credits in case the group of ministers decides to recommend an exemption. Given the adverse public opinion, FMs are keen to be seen taking steps to lower tax burden on those purchasing these two insurance policies.

Going forward, the panel on rate rationalisation is also expected to take up the issue of lower levies for certain farm goods and other common use items. One of the issues being discussed is to reduce the number of items in the 12% bracket and going forward remove it altogether to turn GST into a three-tier tax.