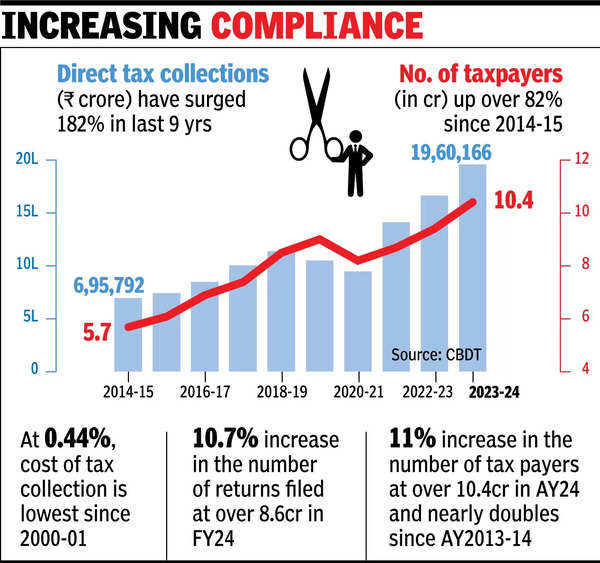

NEW DELHI: The number of taxpayers rose 82% between 2014-15 and 2023-24, while direct tax receipts surged 182% in the past 9 years, largely driven by increasing compliance, data released by tax department on Thursday showed.

The time series data released by the Central Board of Direct Taxes (CDBT) showed the number of taxpayers in the assessment year 2023-24 was at 10.4 crore, up from 5.7 crore in 2014-15.The tax department defines a “taxpayer” as a person who either has filed a return of income for the relevant assessment year (AY) or in whose case tax has been deducted at source in the relevant financial year but the taxpayer has not filed the return of income.

Led by growth in personal income tax, total direct tax receipts in 2023-24 were at Rs 19.6 lakh crore, up 182% from nearly Rs 7 lakh crore in 2014-15. Personal income tax during the 9-year period soared 293% to Rs 10,45,139 crore in 2023-24 from Rs 2,65,772 crore in 2014-15. For the second year in a row, personal income tax collections were higher than corporate tax collections, which rose 112% to over Rs 9,11,055 crore in 2023-24 from Rs 4,28,925 crore in 2014-15, the data showed.

The contribution of direct tax to total tax revenue in 2023-24 reached a 14-year high of 56.7%, up from 54.6% in 2022-23. Advance tax, paid every quarter, receipts rose 291% to Rs 12,77,868 crore in 2023-24 from Rs 3,26,525 crore in 2014-15, while tax deducted at source (TDS) rose nearly 152% during the 9-year period to Rs 6,51,922 crore in 2023-24, from Rs 2,59,106 crore. Advance tax is a tool meant to improve compliance.

The cost of collection was the lowest since 2000-01 at 0.44% in 2023-24 from 1.36% in 2000-01. It has reduced over the years due to better tax administration and efforts mounted by the department.

Tax receipts have surged over the years thanks to the robust economic growth and rising income levels apart from the measures rolled out by the department and the use of technology to plug loopholes and expand the net. The department is also using tools such as artificial intelligence, data analytics to boost receipts and increase compliance.