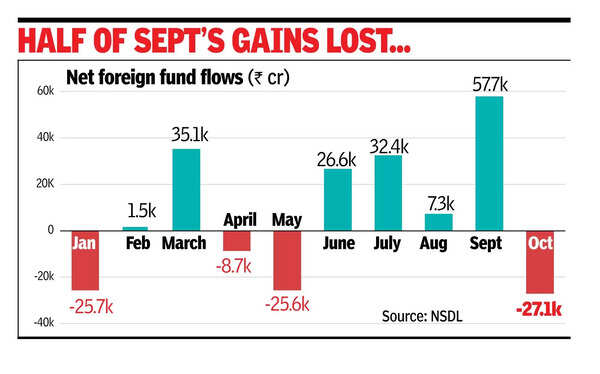

NEW DELHI: Foreign investors have turned net sellers in Oct, offloading shares worth Rs 27,142 crore in just the first three days of the month due to intensifying conflict between Israel and Iran, a sharp rise in crude oil prices, and improved performance of Chinese stock markets.

The outflow came after FPI investment reached a nine-month high of Rs 57,724 crore in Sept.

Since June, foreign portfolio investors (FPIs) have consistently bought equities after withdrawing Rs 34,252 crore in April-May. Overall, FPIs have been net buyers in 2024, except for Jan, April, and May, data with the depositories showed.

Looking ahead, global factors like geopolitical developments and the future direction of interest rates will play a crucial role in determining the flow of foreign investments into the Indian equity markets, Himanshu Srivastava of Morningstar Investment Research India, said.

According to the data, FPIs made a net withdrawal of Rs 27,142 crore from equities between Oct 1 and 4, with Oct 2 being a trading holiday. “The selling has been mainly triggered by the outperformance of Chinese stocks,” V K Vijayakumar of Geojit Financial Services, said.

Hong Kong’s Hang Seng index shot up by 26% in the previous month, and this bullishness is expected to continue since valuations of Chinese stocks are very low and the economy is expected to do well in response to the monetary and fiscal stimulus being implemented by the Chinese authorities, he added.

“Escalating geopolitical tensions, driven by the intensifying conflict between Israel and Iran, a sharp rise in crude oil prices, and the improved performance of the Chinese markets, which currently appear more attractive in terms of valuations, were the primary reasons behind the recent exodus of foreign investments from Indian equities,” Morningstar’s Srivastava said.

This, in turn, has contributed to the recent sharp correction in the Indian equity markets. In terms of sector, FPI selling in financials, especially frontline banking stocks, has made their valuations attractive. Long-term domestic investors may utilise this opportunity to buy high-quality banking stocks, Vijayakumar said.

So far this year, FPIs have invested Rs 73,468 crore in equities and Rs 1.1 lakh crore in the debt market.