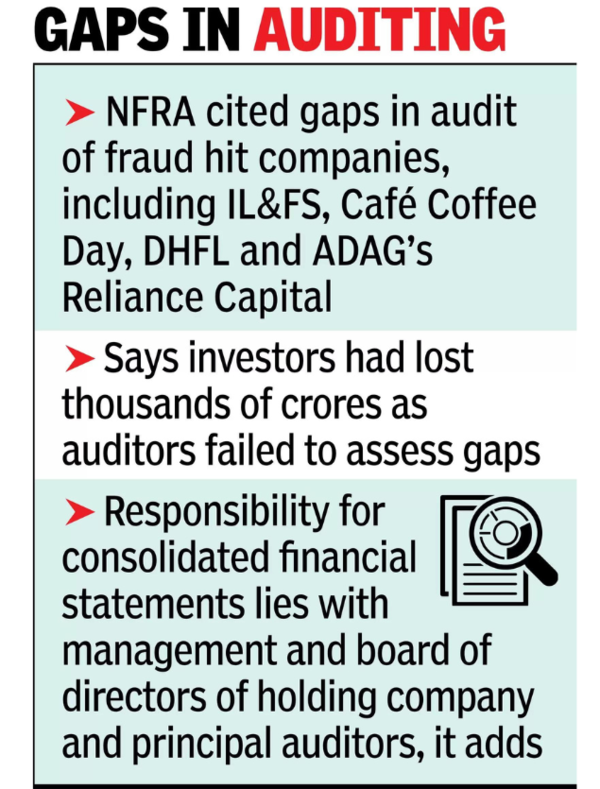

NEW DELHI: The National Financial Reporting Authority (NFRA), the regulator for auditors and audit firms for large and listed companies, on Thursday made clear that the principal auditor will be responsible for the consolidated financial statement in case of group audits after it noticed several attempts to shift the blame to those dealing with subsidiaries and joint ventures.

The agency underlined that the “responsibility for consolidated financial statements lies with the management and board of directors of the holding company and the principal auditors”.

In a 12-page circular, it cited gaps in the audit of fraud hit companies, including IL&FS, Cafe Coffee Day, DHFL and ADAG’s Reliance Capital, Reliance Home Finance and Reliance Commercial Finance to point out how investors had lost thousands of crores as auditors failed to assess gaps.

It underlined that Standard on Auditing (SA) 200 required auditors to “maintain professional skepticism”.

Referring to SA600, the agency pointed out that auditors cannot resort to its “selective” application in group audits. It also dismissed interpretations by auditors, who argued that the provisions of the standard were not mandatory.

NFRA also brushed off suggestions that the principal auditor is barred from reviewing the work papers of auditors of subsidiaries or JVs, saying it is provided under the law as was in SAs. “Section 143 of the Companies Act 2013 grants auditors right of access to all books and vouchers of the company, including right of access to the records of all the subsidiaries of the companies in so far as it relates to the consolidation of its financial statements with that of its subsidiaries,” the circular said.