MUMBAI: Peak XV Partners (formerly Sequoia India) has cut the size of its $2.8-billion fund allocated for investments in India and Southeast Asia by 16% or $465 million. The move comes as high valuations in Indian private markets have slowed down closure of startups’ late-stage growth deals.

The exuberance of public markets, which have been on a bull run, is being mirrored in the private markets where companies are seeking higher valuations from investors.

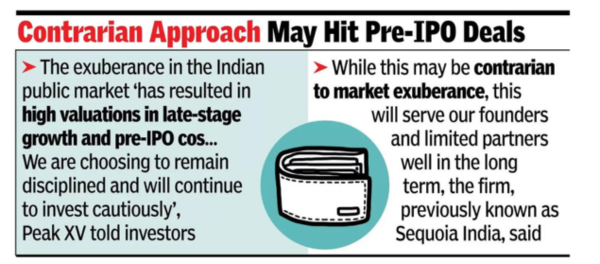

In a letter to its limited partners early on Wednesday, the venture capital firm said that Indian public markets have re-rated up (investors are willing to pay a higher price for shares) and mid-cap P/E multiples have expanded significantly in the last year. “This has resulted in high valuations in late-stage growth and pre-IPO companies. In such an environment, we are choosing to remain disciplined and will continue to invest cautiously,” the firm said in the letter seen by TOI.

The fund – the VC firm’s largest for the region, and floated in 2022 – had earmarked $2 billion for the Indian market and invests across seed, venture and growth stages. However, with the fund resizing, allocations will largely be slashed for late-stage growth deals.

Growth stage startups run scaled up businesses and investors typically cut larger cheques for them to fund their expansion. Peak XV Partners invests $30 million and above in growth deals and has backed startups like Bluestone and Neo through the fund. “While this may be contrarian to market exuberance, this will serve our founders and LPs well in the long term. These changes have been very well received,” the firm said in a statement.

A robust public market have also nudged a spate of startups to go for public listings. Six startups including Ola Electric and FirstCry have gone public, already raising Rs 14,571 crore so far this year and few more new-age tech IPOs including Swiggy’s mega Rs 10,000-crore listing, which is likely to be sized up to Rs 11,700 crore is lined up. The segment is on track to record its best IPO fund-raising since 2021. For its growth and multi-stage funds, Peak XV Partners has also reduced the management fees it charges its LPs to 2% from 2.5% of the total fund size.