MUMBAI: New-age tech IPOs are cashing in on bullish stock market sentiments after anearly three-year lull. With nearly Rs 15,000 crore so far, this year has turned out to be the best for IPO fund-raising since 2021, when the first wave of big startup listings, including Paytm, Zomato & Nykaa, had hit the markets.

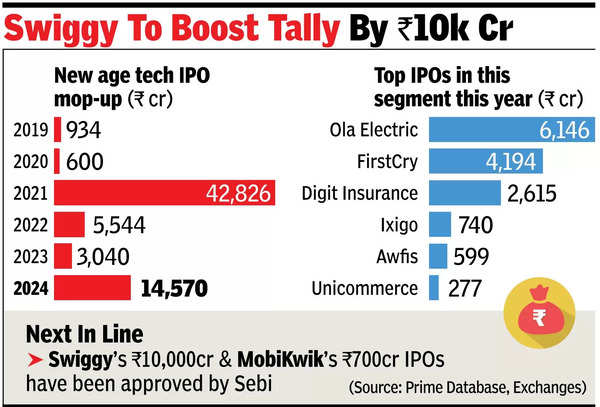

Six new age tech startups, including Ola Electric and FirstCry, have gone public this year raising a combined Rs 14,571 crore, according to Prime Database and exchange data.In 2021, seven startups had together raised Rs 42,826 crore through IPOs (see graphic) . Swiggy and MobiKwik whose IPO filings have been green-lighted by markets regulator Sebi recently are also in the IPO queue.

Swiggy’s Rs 10,000-crore IPO, which is likely to be upsized to Rs 11,700 crore next week, will be the second-biggest startup IPO after Paytm’s Rs 18,300-crore IPO launched in 2021. Logistics startup Blackbuck and electric two-wheeler maker Ather Energy have also filed draft IPO papers as companies look to cash in on robust public markets. Since 2019, about 21 new age tech companies have collectively raised Rs 67,515 crore through IPOs, the data showed.

New age tech IPOs are expected to make up 20-30% of the $15-20 billion worth of IPOs estimated to hit the street in the second half of FY25, Neha Agarwal, MD & head, equity capital markets at JM Financial Institutional Securities told TOI. In H1FY25, the markets saw about $7-billion worth of IPOs.

“With most startups that got listed in 2021 having now delivered operating profitability with strong visibility on PAT (profit after tax) profitability too in the coming quarters, public market investors have finally understood that these businesses can turn profitable and questions regarding the sustainability of business models do not exist anymore,” said Agarwal.

The rush of new age IPOs comes after about a three-year lull when a broader global tech downturn had nudged several startups to go slow on public listing plans with com panies like Snapdeal and Oyo having withdrawn their IPOs. Between 2022 and 2023, only five companies got listed, according to the data. The first wave of big startup IPOs was seen in 2021 when consumer subscription for digital services surged on the back of Covid.

Gaurav Sood, MD and head, equity capital markets at Avendus Capital said that about $75-100 billion of tech market cap is estimated to be added to the public markets over the next three years. “After listing, with the churn of cap tables, we have seen domestic asset managers taking up larger stakes in new age companies. This year is poised to be strong for digital companies… with many more gearing up to file their draft papers,” Sood said.

A slew of startups like Zepto and PhysicsWallah are eyeing market debut in the coming year. The secondary market is at an all time high. A bullish secondary market is always accompanied with heightened primary market activity, said Pranav Haldea, MD at Prime Database Group.