While doing so, it has proposed to restrict it to the audit of listed private companies – which account for under 2% of the 17 lakh active companies in the country. In the process, it also sought to dismiss concerns of small audit firms being hit by the move.

While the International AS 600 was revised in 2009 and 2023, a bunch of auditors have blocked a similar revision in India, despite RBI and Sebi backing the plan. “We are still riding in a Santro car when the world has moved to modern vehicles,” said an official.

In its 35-page consultation paper, NFRA has highlighted how the gap – which does not let the principal auditor coordinate with other auditors of subsidiaries or even check paperwork – has led to multiple failures from Reliance Capital to Reliance Home Finance, Reliance Commercial Finance, DHFL, IL&FS, and Cafe Coffee Day.

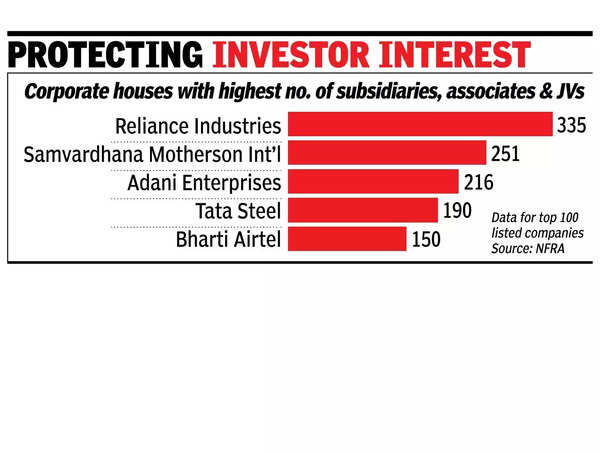

Analysing data, it pointed out how 100 listed companies (excluding banks and insurance companies) had multiple subsidiaries, associate companies, and joint ventures with at least 23 having over 50 such entities, while 76 had overseas entities. In several of these companies, over 50% of the net assets were from subsidiaries, associates, and JVs.

Citing the increase in demat accounts, mutual fund SIPs and pension schemes, the paper said: “The primary reason for proposing adoption of a revised atandard for group audits is to help safeguard public interest and investor protection, and the need for a standards framework that is robust enough to meet the challenges posed by complex financial systems today. The inherent complexity of group structures… cannot be handled by the 2002 version of SA 600 and the related provisions across other standards.”

NFRA also said various panels have underlined the need to converge domestic and global standards.