Apart from sectors, such as health insurance and restaurants, where industry has represented, there could be some food products too, where the branded and packed goods and unpacked ones have different rates, sources familiar with the deliberations told TOI.These may extend to things such as namkeens.

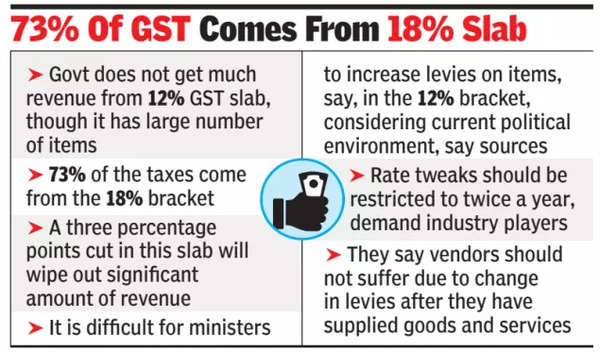

While a large number of items are in the 12% bracket, there is not much revenue coming from the slab. In contrast, 73% of the taxes come from the 18% bracket, said sources. A reduction of even three percentage points in the slab could have shaved off a significant amount of revenue, the source explained.

Given the current political environment, govt sources said, it is difficult for ministers to increase the levies on items, say, in the 12% bracket.

As a result, most of the ministers, who are part of the GoM on rate rationalisation, with Bihar deputy chief minister Samrat Chaudhary as the convenor, opted to leave the slabs unchanged, a decision that is likely to be conveyed to the GST Council when it meets on Sept 9. The other rate changes, focused on specific goods and services, will be worked out in the coming weeks and will then be taken up by the GST Council.

Although there is a strong lobby from the online gaming companies seeking a review of the 28% levy, something that the GST Council had discussed while fixing the rate. An immediate change is unlikely, given the stand that several states and the Centre have taken, arguing that several gamers are losing large amounts of money and a tax should act as a deterrent. Similarly, the demand from the beverages industry may be linked to the larger issue of deciding the future of compensation cess.

Industry players have demanded that instead of undertaking frequent changes, the rate tweaks should be restricted to twice a year so that the vendors do not suffer due to the change in levies after they have supplied the goods and services.