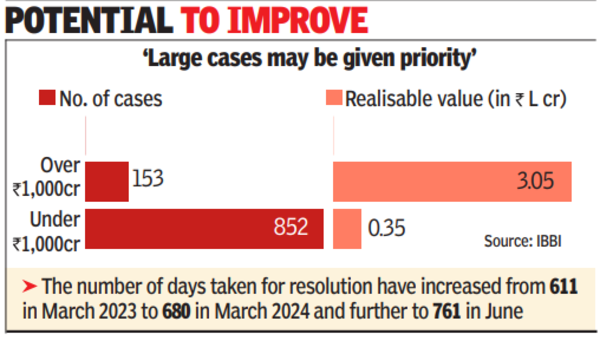

According to data in a recent newsletter from the Insolvency and Bankruptcy Board of India, out of a total of 1,005 cases worth Rs 3.4 lakh crore, the 153 cases with claims exceeding Rs 1,000 crore hold a realisable value of Rs 3.05 lakh crore. This shows the disproportionate impact of large claims on the overall recovery from bad loans.

At present, there are 13,000 cases with approximately Rs 9 lakh crore pending in NCLTs. “Large cases with claims above Rs 1,000 crore may be given priority and dedicated benches should deal with this for closer attention and better outcomes. Creation of dedicated benches for large cases above Rs 1,000 crore has potential to improve turnaround time and value maximisation,” Hari Hara Mishra, CEO of Association of ARCs in India, said.

IBBI’s data also shows that the number of days taken for resolution have progressively increased from 611 as of March 2023 to 680 as of March 2024 and further to 761 days as of June 2024. Similarly, in cases where the borrower has gone to liquidation, the number of days for the order have increased from 455 in March 2023 to 493 days a year later and 680 as of June 2024.

The suggestion for special tribunals for claims over Rs 1,000 crore comes against the background of finance minister Nirmala Sitharaman proposing new benches of the NCLT. Concerned over the increasing delay in resolution of cases under the IBC, Sitharaman in her budget speech last month said that, “Appropriate changes to the IBC, reforms and strengthening of the tribunal and appellate tribunals will be initiated to speed up insolvency resolution. Additional tribunals will be established. Out of those, some will be notified to decide cases exclusively under the Companies Act.”