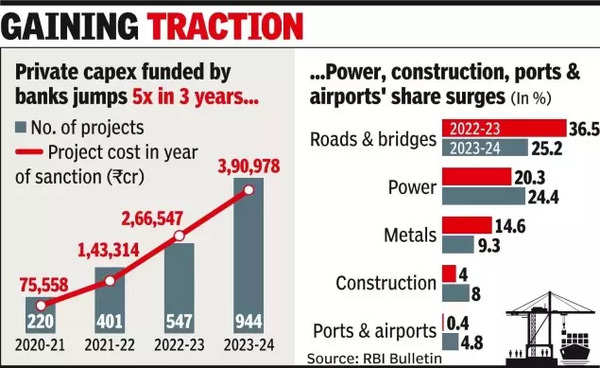

This significant rise is due to rising domestic demand, improved corporate profitability, sustained credit demand, business optimism, and government’s focus on infrastructure development.

The analysis, which is based on projects sanctioned by banks and financial institutions during FY24, reveals that the total cost of these projects reached a record Rs 3.91 lakh crore, with 54% of the planned investment expected to be completed by the end of the financial year. The total capital investment intended by the private corporate sector in FY24, across various funding channels, stood at Rs 4.03 lakh crore – 56.6% higher than the previous year’s planned capex.

The planned capital investment is projected to rise from Rs 1.17 lakh crore in 2023-24 to Rs 1.68 lakh crore in 2024-25. This anticipated growth is bolstered by an increase in funds raised through external commercial borrowings (ECBs) and domestic equity issuances.

The study also highlights the scale and distribution of investment intentions. In FY24, 438 private companies raised Rs 1.68 lakh crore through ECBs, and 123 companies secured Rs 6,310 crore via initial public offerings (IPOs) for capex purposes. Overall, 1,505 projects were initiated during the year, with record investment intentions totalling Rs 5.66 lakh crore, compared to Rs 3.51 lakh crore across 982 projects in the previous year.

The infrastructure sector, particularly in roads, bridges, and power, accounted for the largest share of the total project costs, reflecting the government’s push for infrastructure development. The phasing profile of pipeline projects financed through banks, FIs, and other channels suggests a significant increase in capex for FY25.

The RBI’s study suggests a positive investment climate, supported by healthy corporate balance sheets, improved profitability, and optimistic business sentiments, creating a favourable environment for increased private sector investment in the coming years.