The market watchdog, too, waded in, saying it had acted on the allegations made earlier, with 23 out of the 24 probes completed by March, 2024.“Investors should remain calm and exercise due diligence before reacting to such reports. Investors may also like to take note of the disclaimer in the report that states that readers should assume that Hindenburg Research may have short positions in the securities covered in the report,” Sebi said, while stating it was committed to ensuring market integrity and its orderly growth and development.

Hindenburg’s report had alleged that Puri Buch and Dhaval had investments in two funds with exposure to Adani stocks, which resulted in Sebi “drawing a blank” in its probe against the ports-to-consumer goods conglomerate. It also said Ahuja had served as a director on the board of Adani Enterprises, and insinuated irregularities.

Giving a point-by-point rebuttal, Puri Buch and Dhaval, who have had long corporate careers, said the investment in the fund was made when they were both private citizens.

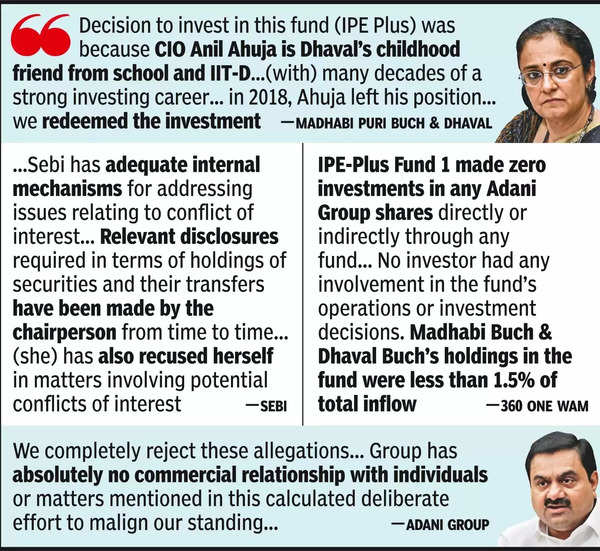

“The decision to invest in this fund was because the chief investment officer, Anil Ahuja, is Dhaval’s childhood friend from school and IIT Delhi and, being an ex-employee of Citibank, J P Morgan and 3i Group plc, had many decades of a strong investing career. The fact that these were the drivers of the investment decision is borne out by the fact that when, in 2018, Ahuja, left his position as CIO of the fund, we redeemed the investment in that fund. As confirmed by Ahuja, at no point in time did the fund invest in any bond, equity, or derivative of any Adani group company,” the statement said.

Separately, 360 One Wam, which ran the fund where the couple had invested, said: “Throughout the fund’s tenure, IPE-Plus Fund 1 made zero investments in any shares of the Adani Group either directly or indirectly through any fund… The fund was managed as a discretionary fund by the investment manager. No investor had any involvement in the fund’s operations or investment decisions. Mrs Madhabi Buch & Mr Dhaval Buch’s holdings in the fund were less than 1.5% of the total inflow into the fund.”

Adani too dismissed the Hindenburg report saying it was “malicious, mischievous and manipulative selections of publicly available information to arrive at pre-determined conclusions”.

It said Ahuja was a nominee director of 3i investment fund in Adani Power (2007-2008) and, later, a director of Adani Enterprises until 2017. “The Adani Group has absolutely no commercial relationship with the individuals or matters mentioned in this calculated deliberate effort to malign our standing. We remain steadfastly committed to transparency and compliance with all legal and regulatory requirements,” the statement said.

In their statement, the Sebi chief and Dhaval said the two consulting companies named by Hindenburg became immediately dormant on her appointment to the regulatory agency. “These companies (and her shareholding in them) were explicitly part of her disclosures to Sebi… When the shareholding of the Singapore entity moved to Dhaval, this was once again disclosed, not just to Sebi, but also to the Singapore authorities and the Indian tax authorities.”

They also dismissed the suggestions of impropriety in Dhaval bagging the advisory role at Blackstone arguing it was on account of his “deep expertise” in supply chain management, a job that he did at Unilever. “…his appointment pre-dates Madhabi’s appointment as Sebi chairperson. This appointment has been in the public domain ever since. At no time has Dhaval been associated with the Real Estate side of Blackstone.”

They insisted that all requisite disclosures had been made. “Sebi has strong institutional mechanisms of disclosure and recusal norms as per the code of conduct applicable to its officers. Accordingly, all disclosures and recusals have been diligently followed, including disclosures of all securities held or subsequently transferred.”