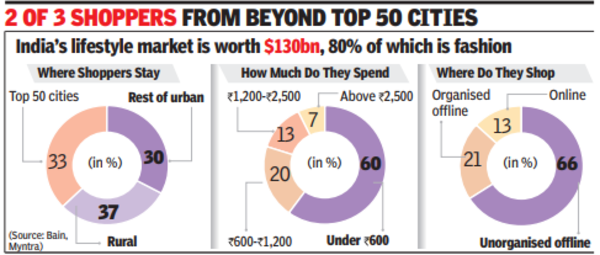

MUMBAI: India’s smaller urban centres and rural regions are driving the growth of the $130-billion lifestyle market, about 80% of which is led by the fashion segment that includes apparel, footwear and accessories. Urban regions beyond the top 50 cities and rural collectively account for about 67% or two-thirds of lifestyle consumption in the country, which is home to a large cohort of young Gen Z shoppers, according to a joint report by Bain and Myntra.

Online platforms have played their fair share in democratising access for consumers — about 50% of more than 175 million e-shoppers come from households with an annual income of less than Rs 10 lakh. Two in three of them come from beyond the top 50 cities.

India lifestyle market

“Online shopping is filling up the access gap. Consumers sitting in beyond the top 50 cities have the same exposure to brands and trends as their metro and tier one counterparts. As consumers become more comfortable, they are buying products across multiple categories and for different occasions. About 40% of our sales from international brands come from tier two plus cities,” Myntra CEO Nandita Sinha told TOI.

The lifestyle market is expected to touch $210 billion by 2028 from about $130 billion currently. The online lifestyle segment, which is pegged at $16-17 billion, is estimated to grow to $40-45 billion by 2028 as the market is still underpenetrated at 13% (of the total market), leaving enough room for growth. “Because of the low penetration base that we have in e-commerce shopping for fashion, there is an opportunity for us to grow beyond the inflationary pressures that the overall market (fashion industry) is seeing,” said Sinha. For Myntra, markets like Jaipur, Patna, and Guwahati are growing very well.

A large part of the growth for the lifestyle market, particularly online, going ahead will come from the Gen Z shoppers. Gen Zs are digital natives who seek fresh fashion trends, buy more frequently and comprise 60 million of the e-lifestyle shoppers. “Gen Z shoppers today account for only 25% of GMV (gross merchandise value). But as they enter the job market, their contribution will go up,” said Shyam Unnikrishnan, partner at Bain. The cohort will also add to the new consumers for online lifestyle shopping from beyond the top 50 cities.

As consumers across income strata upgrade their purchases, helped by improving incomes and premiumise, it will add to the incremental $80-billion spending that the lifestyle market is estimated to see. At present, the price point of less than Rs 600 lead the lifestyle market but going ahead masstige (mass + prestige) plus price points are expected to grow faster.