Gadkari’s suggestion for removal of the levy is unimplementable, since it will break the GST chain, denying refunds to those who sell goods or services to insurers. But many see merit in a reduction. Around six months ago, a parliamentary standing committee headed by Jayant Sinha had underlined the need to reduce GST on health and term insurance.

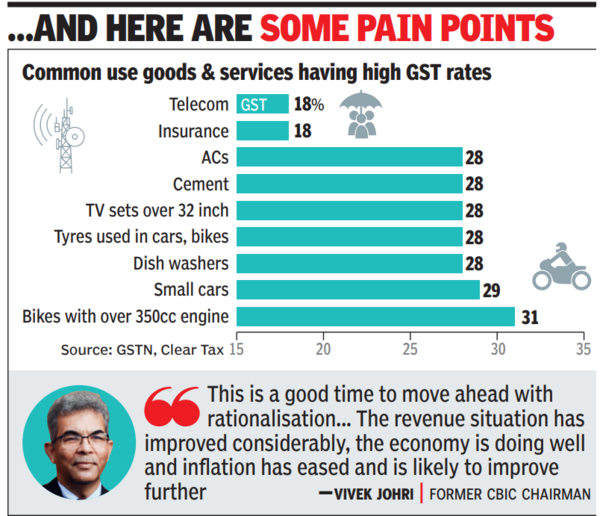

But it isn’t just insurance, govt is seen to be imposing hefty levies on consumers for several other basic services, including telecom, which too attracts 18 per cent, and 28 per cent on air conditioners and cement, which are part of the demerit goods slab. Despite cement being a key construction input, GST Council, comprising the Union and state FMs, has ignored demands for a cut.

A look at your last car invoice would reveal how much tax you have paid to the Centre and states – 43 per cent GST if you bought a “luxury vehicle” (classified as anything which is more than 4 metres long), and a steep registration cost apart from motor insurance, where the premium only keeps rising even if you don’t make a claim, and the govt then levies 18 per cent GST. For a sin goods like gutka or pan masala, the effective rate is in three digits.

For several years, GST Council has been talking about reviewing rates but has refused to move even as tax collections rose month after month. There are talks of discussions starting at the next meeting, but it is unlikely that a decision will be taken for several months. For that, a panel of ministers led by Bihar deputy chief minister Samrat Chaudhary needs to work out a blueprint and that will also be linked to the item-by-item review by the GST Council secretariat to ensure that there is no revenue loss.

The rationalisation of GST rates is overdue. It was to be undertaken a few years after its rollout. Initially, Covid played spoilsport. Although the finance ministry faces much of the flak for tax rates, officials said, the states were not keen as they feared a revenue loss at a time when compensation cess was to be phased out. Compensation cess was a temporary measure to ensure 14 per cent annual growth in revenue for states for five years. But it had to be extended in the wake of Covid.

What added to the conundrum was higher inflation and the prospects of the 12 per cent and 18 per cent rates being merged to a median rate of 15-16 per cent. That will marginally lower rates for biscuits, ice cream, paints, refrigerators and TV sets (up to 32 inches) as well as insurance and telecom. This will also mean that bicycles, clothing and footwear that cost up to Rs 1,000 a pair, pencils, pre-packed namkeen and bhujia and several other food items will see a price increase as they will attract a higher levy than the current 12 per cent.

Besides, it will also entail the GST Council to not just increase the 5 per cent rate to 7-8 per cent to not just ensure steady revenue but also narrow the difference between the new median rate and the rate for merit goods.

For the govt, almost two-thirds revenue comes from the 18 per cent slab and another 15-20 per cent from goods and services that attract 28 per cent. While a third of the items, mostly household, are in the 5 per cent segment, their contribution to revenue is in single digits. There has been a suggestion to bring some tax-exempted goods under the tax net.

“This is a good time to move ahead with rationalisation, which cannot be done overnight as the entire exercise will take a few months. The revenue situation has improved considerably, the economy is doing well and the inflation has eased and is likely to improve further,” said former CBIC chairman Vivek Johri.

Tax experts have been demanding the change for months. “The process of rationalising the rates of GST and compressing the rate slabs in GST should now begin as the tax has now entered a stable phase with stable collections, increased compliance, and the growing focus on audits. Tax simplification has, in the past, led to increased collections arising from improved acceptance and the resultant growth in the number of compliant taxpayers,” said M S Mani, partner at Deloitte India.

GST Council will have to decide the road map for cess on items like tobacco products, pan masala, automobiles, coal and soft drinks. The rationalisation exercise will come with its own challenges. For instance, lowering GST on insurance to the lowest slab will mean that several inputs face higher levy and tax refunds will be an issue as refund outgo will be larger than tax collected in the final stage.