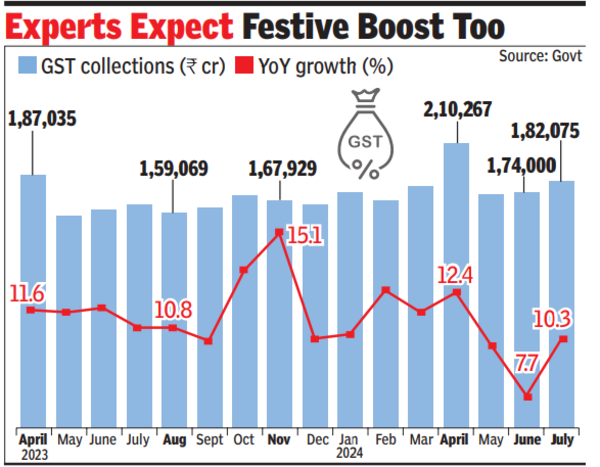

Barring the top two grossers (April 2023 and April 2024), when collections soar due to year-end sales in March, the collections in July 2024 (for transactions in the previous month) are the highest.The numbers also indicate that the slowdown in June was on account of the countrywide heatwave that impacted economic activity.

The other good news from the latest numbers is an indication of a turnaround in imports as GST from imports – integrated GST and cess – is estimated to have increased 14% to Rs 47,000 crore, the fastest since Nov 2022. What’s more, growth in collections from this source was more than domestic sources, which rose 8.9% to Rs 1,34,000 crore.

While the govt did not comment on the numbers, tax experts appeared positive. “Growth in year-to-date collection in FY25 of around 11% is broadly in line with the Budget estimates, while the growth in monthly collection over last year (net revenue) is encouraging at over 14%. This should enable govt and GST Council to start working towards rate rationalisation,” said Pratik Jain, partner at PwC India.

Abhishek Jain, who leads indirect tax practice at rival firm KPMG, said the ensuing festival season will further help swell the kitty.

Like most months, several north eastern states were top performers and what will buoy political sentiments is a 61% jump in Manipur. After Ladakh’s 67% rise, Manipur logged the second-highest increase.