The official, who spoke on condition of anonymity, told ET “The decision followed a reassessment of various factors, including investor demand, other investment products and uncertainties around the global economy, as the situation has changed since the interim budget in February.”

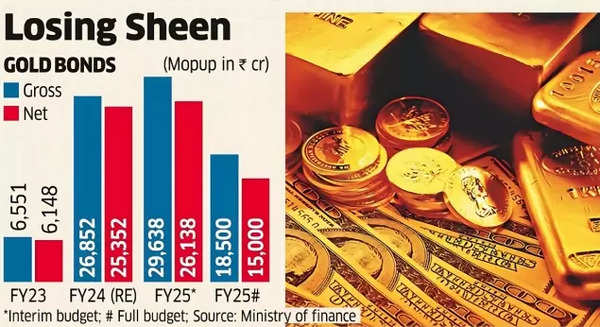

After accounting for redemptions, the net issuances of sovereign gold bonds are now estimated at Rs 15,000 crore for this fiscal year, a significant decrease from the Rs 26,138 crore projected in the interim budget and Rs 25,352 crore in the revised estimate for 2023-24.

Gold Bonds losing sheen

Harish Galipelli, director at ILA Commodities India, attributed this shift to retail investors increasingly opting for equities in anticipation of better returns. He also noted that people are uncertain about the potential for further increases in gold prices in the short-to-medium term following a recent rally. Additionally, Galipelli pointed out that savings in rural areas have been impacted by retail inflation and other factors.

The gold bond and gold monetisation schemes were introduced by the government in late 2015 to discourage the physical purchase of precious metals and reduce imports, thereby mitigating the negative impact on the current account deficit.

The gross collection through these two schemes is now projected to be Rs 20,030 crore in 2024-25, compared to Rs 31,168 crore in the interim budget and Rs 28,240 crore (revised estimate) in the previous fiscal year. Similarly, the net collection is estimated at Rs 16,433 crore, down from Rs 27,571 crore in the interim budget and Rs 26,653 crore in the previous year. However, the estimates for the gold monetisation scheme remain unchanged from the interim budget level.

Also Read | Budget 2024: Duty cuts on gold, silver, platinum, and diamonds to make jewellery more affordable

The sovereign gold bond scheme targets investors who view gold as an investment, encouraging them to purchase paper gold instead of physical gold.

On the other hand, the gold monetisation scheme aims to bring out idle gold held by households, temple trusts, and others to increase domestic supply. Both schemes were designed to curb gold imports, which, along with crude oil, have been significant contributors to India’s current account deficit. Gold bond issuances had moderated after reaching Rs 16,049 crore during the Covid-19 pandemic in 2020-21, before experiencing a surge in 2023-24.