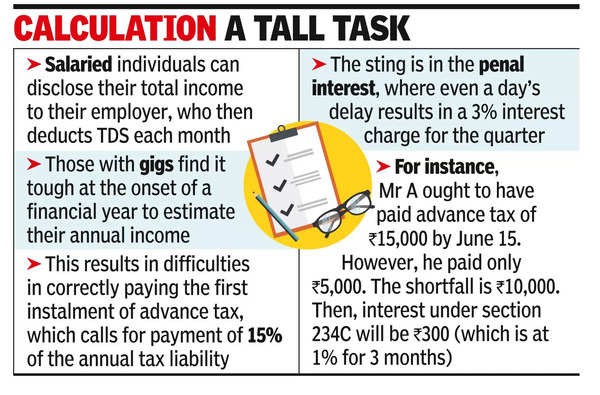

Non-salaried have to meticulously compute and pay their own advance taxes. The Income-tax (I-T) Act prescribes for payment of advance taxes if a taxpayer’s liability is more than Rs 10,000.Salaried individuals can disclose their total income (including the non-salary portion, such as bank interest) to their employer, who then deducts tax at source (TDS), each month. If not, they must ensure advance taxes are duly paid as the tax deducted at source by the employer would not cover their entire tax liability.

Those with income flowing from gigs find it difficult at the very onset of a financial year to estimate their income for the entire year. This results in difficulties in correctly paying the first instalment of advance tax, which falls due on June 15 – within just 75 days from the start of the new financial year. The first instalment calls for payment of 15% of the annual tax liability.

Under section 44ADA of the presumptive scheme, individuals can pay their entire advance tax in one instalment by March 15. However, moonlighters (who also hold a job) typically do not opt for the presumptive tax scheme where 50% of the gross revenue has to be offered to tax. Further, this side income is not disclosed to the employer to facilitate TDS.

Section 234C provisions, which entail payment of interest for an entire three-month period for non-payment or shortfall in a particular instalment till the next instalment, date is perceived as harsh.

Currently, 15% of the tax liability for the year is to be paid by June 15, 45% by Sept 15, 75% by Dec 15 and the full sum by March 15. Prior to the 2016 amendment, the three due dates for payment of advance taxes for individuals were Sept 15 (30% of the tax liability), Dec 15 (60% of the tax liability) and March 15 (100% of the tax liability).

The Bombay Chartered Accountants Society (BCAS), in its pre-Budget memorandum, states that prior to the 2016 amendment, only corporates had to pay advance tax in four instalments. In addition to seeking reinstatement of a three-instalment mechanism for individuals, it adds that the threshold limit of Rs 10,000 – which was set by the Finance Act, 2009 – needs a suitable upward revision.

The sting lies in the penal interest prescribed under section 234C of the I-T Act. Sandeep Jhunjhunwala, partner at Nangia Andersen LLP, said, “Even a one-day delay in any of the first three quarterly instalments results in a substantial 3% interest charge for the delayed quarter. Ideally, a more nuanced approach should be implemented. For example, if the June 15 instalment is paid by July 14, a lower interest rate of perhaps 1% could be applied.”