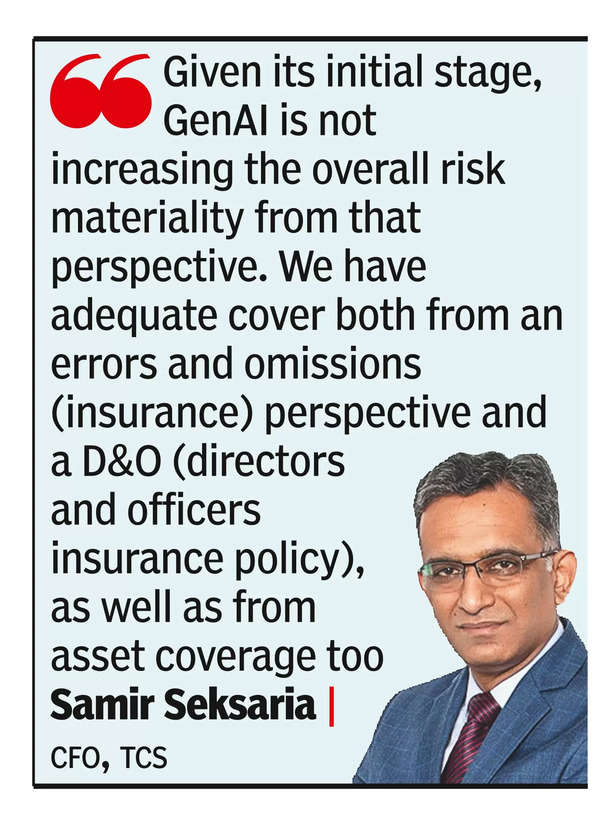

“Given its initial stage, GenAI is not increasing the overall risk materiality from that perspective. We have adequate cover both from an errors and omissions (insurance) perspective and a D&O (directors and officers insurance policy), as well as from asset coverage too.Structurally, these are risks that are taken care of by the project management team, and our legal team is involved in looking at what the exposures could be, and we continue to mitigate them. Insurance is just a fallback to it,” he said. Errors & omission insurance protects businesses and their employees from negligent actions from clients.

As companies embrace GenAI for proof-of-concept to create new revenue upsides, they are evaluating new claims that could emerge from D&O insurers, SEC proceedings, and AI disclosure-based claims. Seksaria also highlighted the company’s substantial insurance coverage, amounting to hundreds of millions of dollars, which covers a wide range of risks. Seksaria emphasised that these risks are managed by the project management team, with the legal team assessing potential exposures and continuously working to mitigate them. TCS is currently executing about 270 GenAI projects, and its AI and GenAI pipeline has doubled to $1.5 billion in the June quarter.

“The pipeline first needs to convert into an order book, then into revenues. So, once we get a more stable outlook coming from it, that is when we’ll start considering publishing those metrics. There could be new risks emerging from GenAI, and how we deal with it. IP protection becomes a big issue, and it is one of the risks that everyone will have to look into,” he added.

TCS’s operating margin dropped 130 basis points sequentially to 24.7% on account of a wage hike, but on a year-on-year basis, it expanded by 1.5%. “The overall impact of increments is 170 basis points, which has been in line with what we have called out in the past, which is anywhere between 150 to 200 basis points. We have been driving better productivity, improved utilisation, and reducing subcontractor costs. The first two factors reflect positively on the manpower cost, and that balances out some of the impact of increments in this quarter as well,” said Seksaria. Its operating margin is inching towards its aspirational 26% to 28% band. Seksaria said currency, in the last year, has remained stable and range-bound. Currency depreciation does help, but we have not seen that play out materially. The levers which we look towards in the short term will be more in terms of driving productivity and improved utilisation.